Featured Posts

Financial Services

ATR Op-Ed in American Banker: “The Fed’s manipulation of debit card interchange fees must stop”

On April 25, 2024, American Banker’s commentary page, BankThink, published an op-ed written by ATR’s director of financial policy, Bryan Bashur. The piece…

Spending & Regulatory Reform, Tax Reform

Worst of Both Worlds: U.S. Economic Growth Slows as Inflation Rates Rise

Today, the Commerce Department released a snapshot of its growth report for the first quarter. The country’s gross domestic product (GDP) grew by just…

Tax Reform

No Tax Cut for Kansans, says Governor Kelly after vetoing bipartisan package

Kansas Governor Laura Kelly (D) callously vetoed a bipartisan tax relief package on Wednesday that included income, property, and business tax cuts totaling just $460…

Filtered Posts

Buttigieg Would Repeal the Entire Trump Tax Cut

How the Trump Tax Cuts Have Helped Ohio

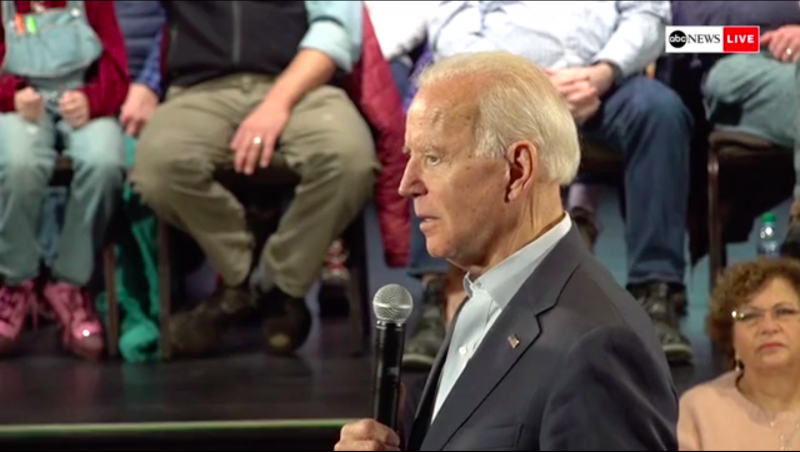

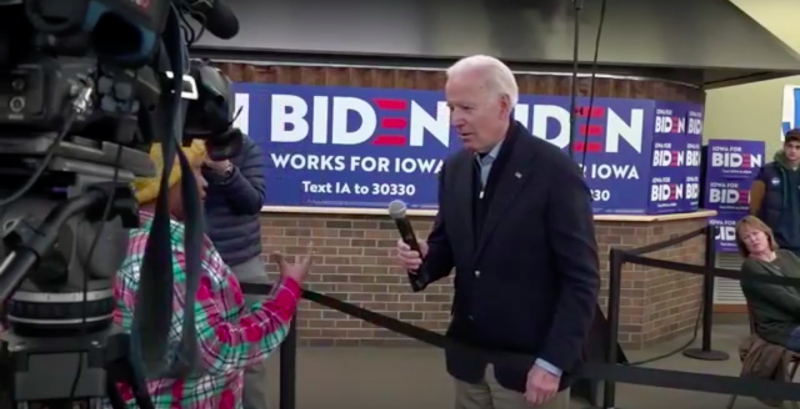

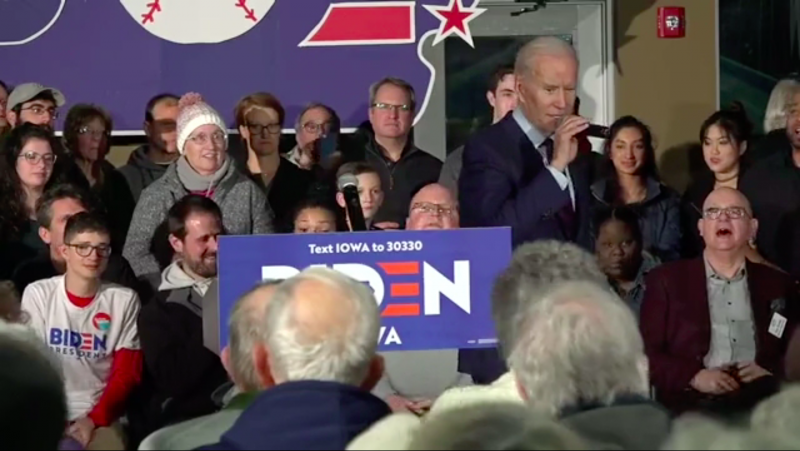

Biden Lies About Trump GOP Tax Cut, Claims It “Affected Very Few People”

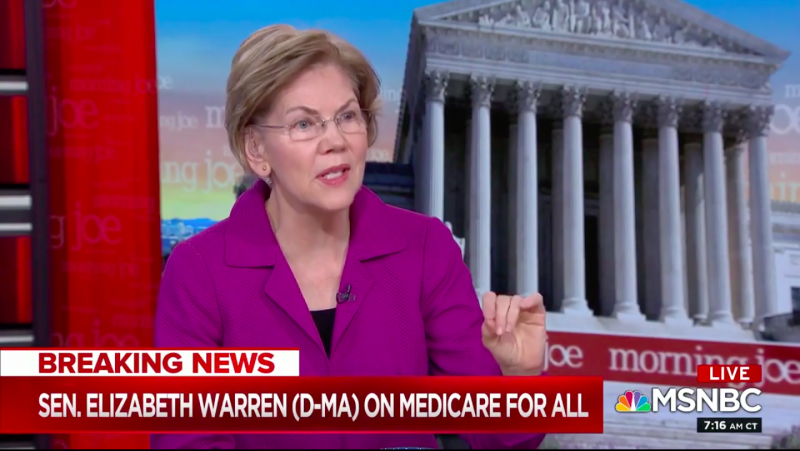

Warren Tells Another Lie on The View: “I Don’t Have Plans That Increase Taxes On The Middle Class.”

Warren Dodges Private Healthcare Question Three Times During Morning Joe Interview

Biden Calls for Plastic Bag Ban: “We should not be allowing plastic.”

Biden: “Get Rid of the Trump Tax Cut”

Joe Biden Suggests He Would “Eliminate” Vaping If Elected

Pete Buttigieg: “We Gotta Roll Back the Trump Tax Cuts for Corporations”