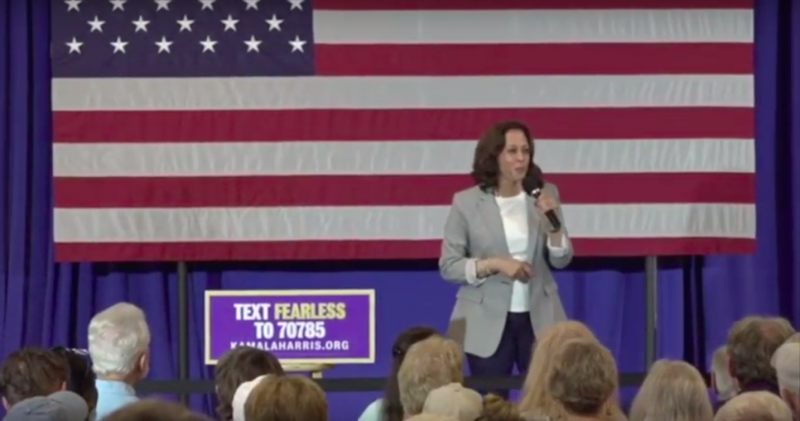

2020 Democratic presidential candidate Kamala Harris has threatened to repeal the Tax Cuts and Jobs Act at least three times in the month of August.

“On day one, we are going to repeal that tax bill that benefits the top one percent and the biggest corporations in our country,” Harris said in Denver, Colorado on August 2.

“On day one, we’re going to repeal the tax bill that benefits the top one percent and the biggest corporations in America,” Harris said in Mount Pleasant, Iowa on August 11.

“On day one, we’re going to repeal that tax bill benefiting the top one percent and the biggest corporations in our country,” Harris said in Davenport, Iowa on August 12.

While Harris was speaking at a NAACP fundraiser in May, she threatened to “get rid of the whole thing,” if elected president.

A promise to repeal the tax cuts is a promise to raise taxes. If the tax cuts were repealed:

- A family of four earning the median income of $73,000 would see a $2,000 tax increase.

- A single parent (with one child) making $41,000 would see a$1,300 tax increase.

- Millions of low and middle income households would be stuck paying the Obamacare individual mandate tax.

- Utility bills would go up in all 50 states as a direct result of the corporate income tax increase.

- Small employers will face a tax increase due to the repeal of the 20% deduction for small business income.

- The USA would have the highest corporate income tax rate in the developed world.

- Taxes would rise in every state and every congressional district.

- The Death Tax would ensnare more families and businesses.

- The AMT would snap back to hit millions of households.

- Millions of households would see their child tax credit cut in half.

- Millions of households would see their standard deduction cut in half, adding to their tax complexity as they are forced to itemize their deductions and deal with the shoebox full of receipts on top of the refrigerator.

In Iowa, where Harris promised to repeal the TCJA, households making the average income, $76,076, received an average tax cut of around $1,423, according to a recent Tax Foundation report. According to the same report, every congressional district in America received a tax cut.

In Colorado, households making the average income of $84,918, received an average tax cut of around $1,594, according to the report.

The Washington Post also stated: “Most Americans received a tax cut.”

More evidence of the benefits flowing from the tax cuts can be found in a recent H&R Block report, which stated, “overall tax liability is down 24.9 percent on average.”

In Harris’s home state of California, the report found that residents received a 27.1% reduction in their taxes, on average. In the states where Harris made the tax hike threat – Colorado and Iowa – residents received a 24.7 and 24 percent tax cut, respectively, on average.

Even left-leaning and establishment media outlets confirm the good news arising from the Tax Cuts and Jobs Act:

- The New York Times also flatly stated: “Most people got a tax cut.”

- CNN’s Jake Tapper did his own fact check and concluded: “The facts are, most Americans got a tax cut.”

- CNN’s Jake Tapper also stated: “In fact, estimates from both sides of the political spectrum show that the majority of people in the United States of America did receive a tax cut.”

- FactCheck.org stated: “Most people got some kind of tax cut in 2018 as a result of the law.”

- FactCheck.org also stated: “The vast majority (82 percent) of middle-income earners — those with income between about $49,000 and $86,000 — received a tax cut that averaged about $1,050.

- The NYT also stated: “To a large degree, the gap between perception and reality on the tax cuts appears to flow from a sustained — and misleading — effort by liberal opponents of the law to brand it as a broad middle-class tax increase.”

If you want to stay up-to-date on their threats to raise taxes, visit www.atr.org/HighTaxDems.

See more:

Joe Biden: “I’m going to eliminate most all” of GOP Tax Cuts

Cory Booker Calls for Repeal of “Toxic” GOP Tax Cuts

Marianne Williamson Joins Dems Calling for TCJA Repeal

Kamala Admits Her Plan Would End Employer Insurance

“Medicare for All” is a Middle Class Tax Increase, Say Dems

Elizabeth Warren Can’t Dodge the Middle Class Tax Question Forever

Dem Socialized Healthcare Plan Will Lead to Middle Class Tax Hikes

Supposed “Moderate” Democrat John Delaney Wants to Impose Carbon Tax on the American People

Klobuchar Suggests Capital Gains Tax Hike and “Doing Something” About TCJA

Kamala Harris Campaign Headquarters Located in Opportunity Zone Created by GOP Tax Cuts

Julian Castro: “We’re going to have to raise taxes.”

Biden and Harris: Raise the Corporate Tax Rate

Biden tweet: Ignore the fact I’ve already called for middle class tax hikes

Kamala Harris: “I Will Reverse” Trump’s Tax Cuts

Kamala Harris Calls for Repeal of Tax Cuts Four Times in Three Minutes

Julian Castro Caught Lying about GOP Tax Cuts

NYT: Bidencare Will be Funded by “rolling back” GOP tax cuts

Kamala Harris: I Will Repeal “That Tax Bill”

Cory Booker: “I do support” Imposing Carbon Tax on Americans

Harris: “We are Going to Repeal That Tax Bill”

Biden: I Will Raise Corporate Tax Rate to 28%

Kamala Harris Continues to Lie about Tax Cuts

Jay Inslee: “Repeal the Trump Tax Cuts”

Biden Running Ads to “Repeal Trump’s Tax Cuts.”

VIDEO: Ten Times Biden Threatened to Repeal Tax Cuts

Here’s what happens if Dems repeal tax cuts

VIDEO: 10 Times 2020 Democrats Have Threatened to Repeal TCJA

Kamala Harris: When I Enter Office “I Will Repeal” the TCJA

Biden: “First thing I would do as President is Eliminate the President’s Tax Cut.”

Bernie Sanders claims people would be “delighted to pay more in taxes”

Biden: Tax Cuts Will be “Gone” If I’m Elected

Kamala Harris: I Will Repeal Tax Cuts “on day one”

Biden again says capital gains tax is “Much too Low”

Biden: Capital gains tax “much too low”

VIDEO: Five Times Biden has Threatened to Repeal Tax Cuts

Biden: “First thing I’d do is repeal those Trump tax cuts.”

Joe Biden broke his middle class tax pledge

“Mayor Pete” Calls for Steep Tax Hike on Homes and Businesses

Kamala Harris Vows Repeal of Tax Cuts “on Day One”

Biden: “When I’m President, if God willing I am, we’re going to reverse those Trump tax cuts.”