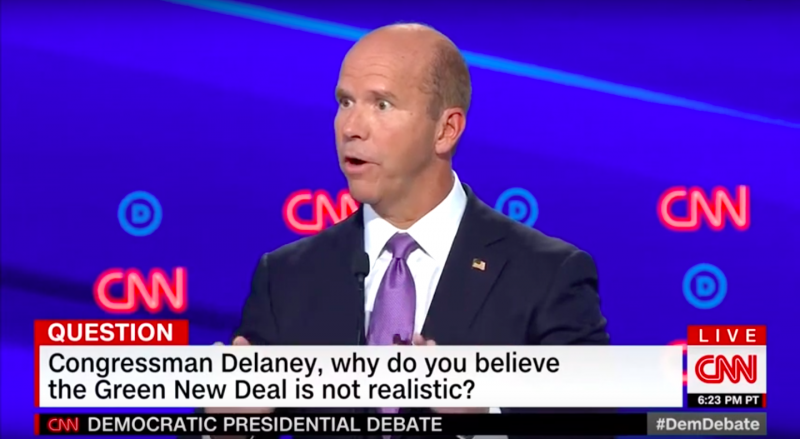

During the CNN Democratic debate tonight, presidential candidate John Delaney said he would impose a carbon tax on the American people if elected to White House.

“I put a price on carbon, take all the money, give it back to the American people in a dividend,” said Delaney.

Delaney likes to fashion himself a “moderate” but his carbon tax scheme is a massive tax increase that would expand the power of the federal government and hit the poor especially hard. Like all carbon taxes, Delaney’s carbon tax automatically ratchets up every year, allowing politicians to raise taxes again and again without having to vote on it.

Carbon taxes, regardless of their structure, make everything more expensive, so proponents say someone in Washington will send out payments slickly called “dividends.” This would require a large bureaucracy to implement and run and would saddle households with paperwork and tax obligations.

Carbon taxes put a big burden on small businesses operating on tight margins and saddle state and local governments with huge costs. For example, a school district in Calgary was forced to kick 400 kids off the school bus program in order to pay a $3.3 million carbon tax bill.

In addition, the “dividends” are subject to federal income tax and eventually state and local taxes. The tax will not only siphon money from households to be sent to Washington — it will also impact Social Security benefits.

A report published by the pro-carbon tax Citizens’ Climate Lobby acknowledges the following:

“Taxability of Dividends raises three separate issues: (i) additional complexity for taxpayers; (ii) the equity of the disparate effective marginal tax rates on taxable Dividends for various residents; and (iii) the method or methods by which those taxes would be paid.”

Regarding Social Security recipients, the report states:

“Over the income-related phase-in range for the taxation of social security benefits, each additional $1.00 of non-social security income causes an additional $0.50 or $0.85 of social security benefits to become taxable. In most situations, the ordinary income tax rate in the phase-in range is 10 percent; however, at some income levels, the rate is 12 percent. Thus, $1.00 of non-social security income — including income from the Dividend — will be taxed at effective marginal rates of 15 percent, 18 percent, or 22.2 percent.”

The report gives an example of how the tax would hit a typical couple over age 65 with an income of $38,000 and a Social Security benefit of $12,000:

“Based on that income, the tax rate schedule shows that their marginal tax rate would be 10 percent. However, the addition of $1,584 of taxable Dividends from the Carbon Fee causes more of their social security benefits to become taxable, and their marginal tax rate due to the Dividends is 20.12 percent, so that after paying their income tax, the couple is left with only 79.88 percent of their gross Dividend.”

Citizens’ Climate Lobby was caught on tape admitting carbon tax cost and complexity is “something that we at CCL can tend to soft-pedal.”

It’s no wonder 75 conservative groups wrote a letter to congress stating: “We oppose any carbon tax.”

Delaney is the latest in a long line of Democrats seeking to impose a carbon tax on American households. The official Democrat party platform endorses a carbon tax, while the Republican platform opposes any and all carbon taxes.

Voters nationwide consistently reject carbon taxes at the ballot box, even in blue states.