Featured Posts

Tax Reform

Yellen Feigns Ignorance of Biden Vow to End the Trump Tax Cuts

Biden said Trump-enacted tax cuts “are going to stay expired and dead forever if I’m re-elected.” In a House Ways and Means Committee…

Tax Reform

Questions for Yellen Ahead of Ways and Means Hearing

Biden tax increases: President Biden last week said twice that he would let the entire Tax Cuts and Jobs Act expire and die if…

Tax Reform

Congestion Tax Highly Unpopular in New York

An overwhelming majority of New York voters oppose the new $15 “congestion toll” that is set to take effect in June. According to…

Filtered Posts

ATR Applauds Governor Ron DeSantis for Vetoing Flavored Vaping Ban

California’s Assault Against Ride-Sharing Services Shows Why National Preemption Necessary to Save the Gig Economy

Where Do the 2020 Democrats Stand on Vaping?

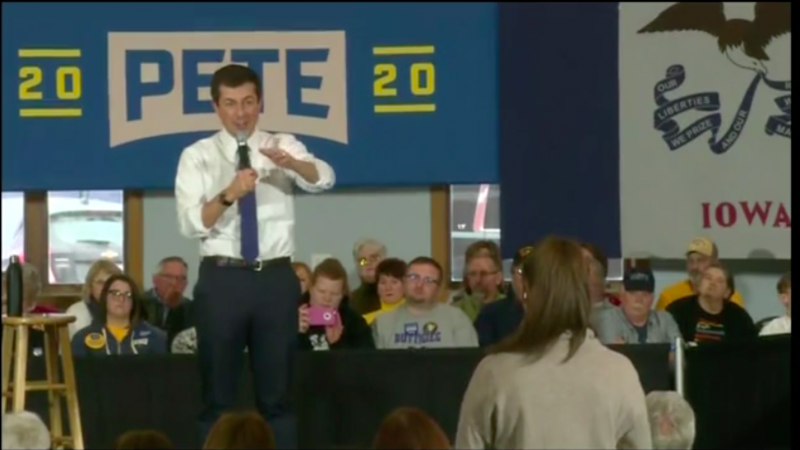

Pete Buttigieg Confuses Marijuana With Nicotine and Signals He’d Impose Harsher Regulations on Vaping

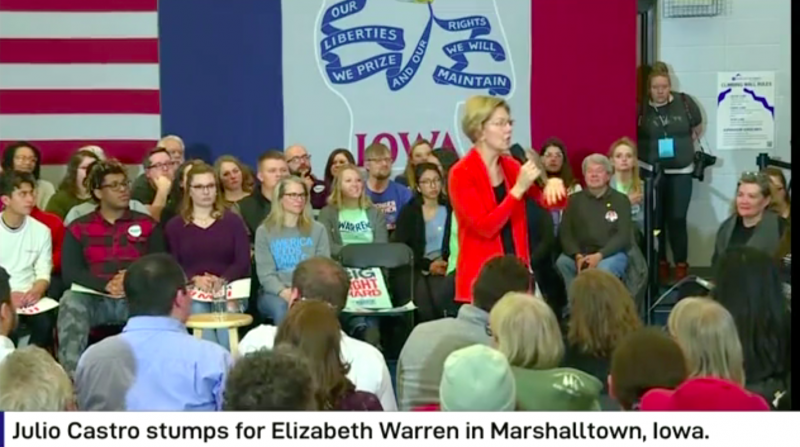

Elizabeth Warren’s Anti-Vaping Extremism Ignores Benefit of Vaping for Adult Smokers

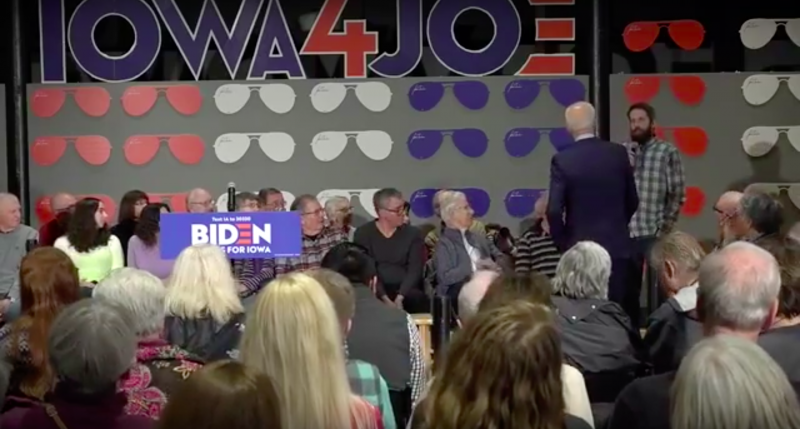

Joe Biden Suggests He Would “Eliminate” Vaping If Elected

FDA’s Decision to Ban Some Vapor Products is a Compromise But Not a Complete Victory

Morning Consult Poll of Trump Voters: “Flavor Ban Could Cost Him Tenth of His Voters”

Congress Should Reject Additional Online Sales Restrictions for Adults Who Buy E-Cigarettes