Featured Posts

Tax Reform

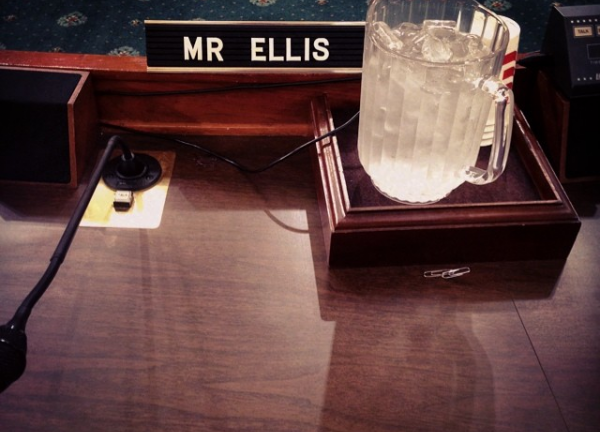

Yellen Feigns Ignorance of Biden Vow to End the Trump Tax Cuts

Biden said Trump-enacted tax cuts “are going to stay expired and dead forever if I’m re-elected.” In a House Ways and Means Committee…

Tax Reform

Questions for Yellen Ahead of Ways and Means Hearing

Biden tax increases: President Biden last week said twice that he would let the entire Tax Cuts and Jobs Act expire and die if…

Tax Reform

Congestion Tax Highly Unpopular in New York

An overwhelming majority of New York voters oppose the new $15 “congestion toll” that is set to take effect in June. According to…

Filtered Posts

The Return of the King: A King’s Ransom

Processing Error Leaves 16,000 Minnesotans Without Health Insurance

Happy Fourth of July! BBQ, Fireworks, and Historically High Gas Prices

Ohio Gov. Kasich Freezes Renewable Energy Standards

Upcoming Tax Filing Season Could Be the Most Chaotic in Years

Obamacare Still Raises Debt by Trillions

Numbers Never Lie; The True Cost of Obamacare

Get Ready to Pay Capital Gains Tax on Your Bitcoins