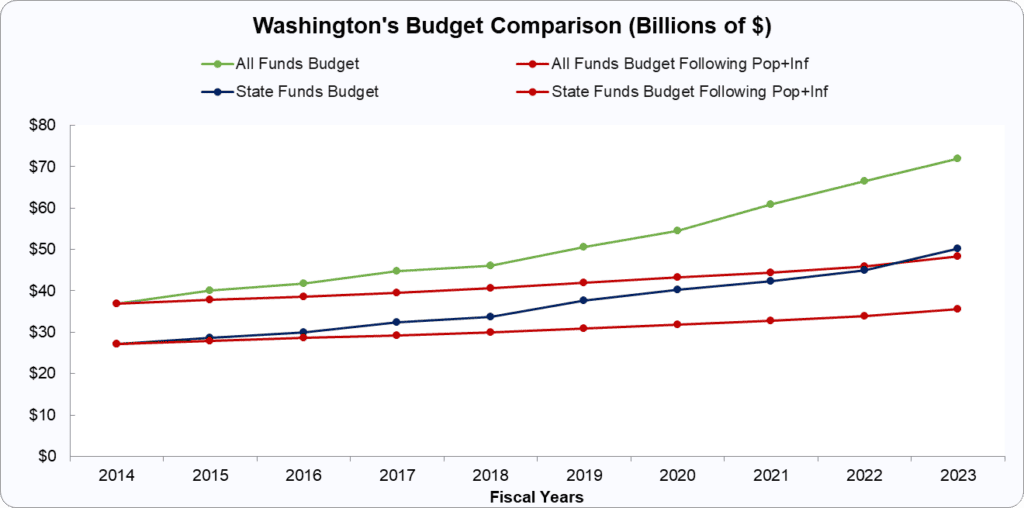

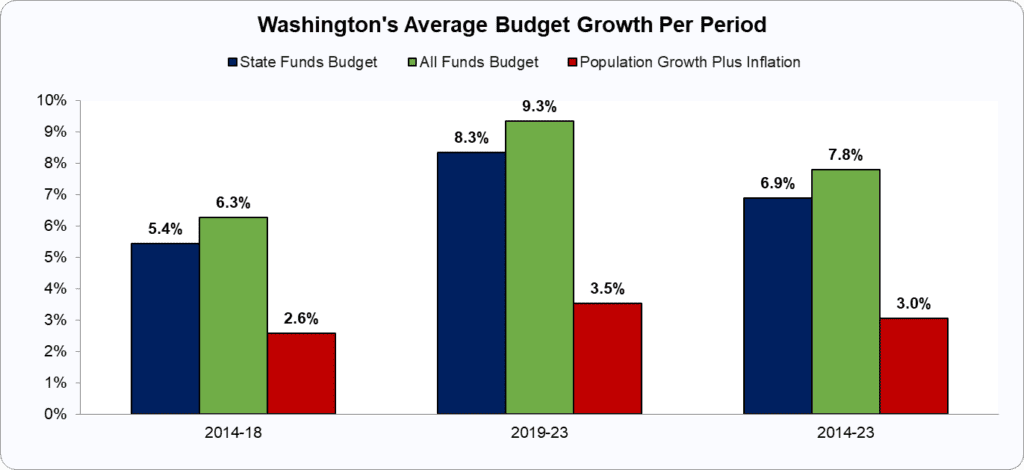

Washington’s budget increased cumulatively more than pop+inf in state funds and all funds from 2014-23, meaning taxes are higher than the average taxpayer can afford.

- The 2023 state funds budget is $14.6 billion higher than it would have had spending grown at the rate of population growth plus inflation over the past decade.

- Because the state funds budget grew faster than population growth plus inflation for the last ten years, the state spent and taxed $59.1 billion too much.

- The 2023 all funds budget is $23.6 billion higher than it would have been had spending grown at the rate of population growth plus inflation over the past decade.

- Because the all funds budget grew fsater than population growth plus inflation over the past decade, the state spent and taxed $96.6 billion too much.

State Funds Budget Data

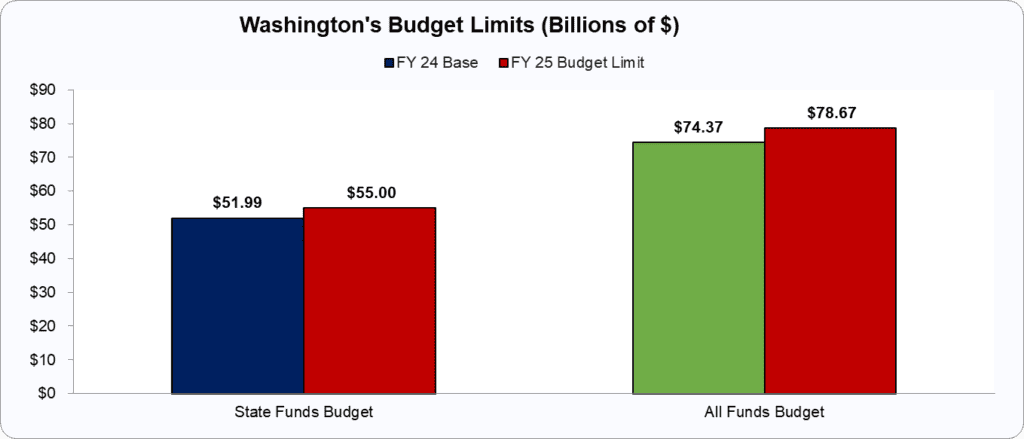

- Estimated FY 2024 Only State Funds Budget ($ Billions): $51.99

- FY 2025 Only State Funds Budget Limit ($ Billions): $54.98

- FY 2025 Only State Funds Budget Limit Growth ($ Billions): 5.74%

- Cost per person of state funds budgeting more than pop+inf over the last decade in 2023 budget: $1,871

- Cost per family of 4 of budgeting more than pop+inf over the last decade in 2023 budget: $7,483

- Cumulative cost per person of state funds budgeting more than pop+inf over the last decade from 2014-23: $7,561

- Cumulative cost per family of 4 of state funds budgeting more than pop+inf over the last decade from 2014-23: $30,243

State All Funds Budget Data

- Estimated FY 2024 All Funds Budget ($ Billions): $74.37

- FY 2025 All Funds Budget Limit ($ Billions): $78.63

- FY 2025 All Funds Budget Limit Growth ($ Billions): 5.74%

- Cost per person of all funds budgeting more than pop+inf over the last decade in 2023 budget: 3,026

- Cost per family of 4 of all funds budgeting more than pop+inf over the last decade in 2023 budget: 12,104

- Cumulative cost per person of all funds budgeting more than pop+inf over the last decade from 2014-23: 12,361

- Cumulative cost per family of 4 of all funds budgeting more than pop+inf over the last decade from 2014-23: 49,445

Other Considerations

- Economic Freedom of North America (2021) (Rank): 29 [Fraser Institute]

- Economic Freedom (2022) (Rank): 38 [Cato Institute]

- Fiscal Policy (2022) (Rank): 28 [Cato Institute]

- Regulatory Policy (2022) (Rank): 41 [Cato Institute]

- State Tax Collections Per Capita (FY2021) ($): $4,214 [Tax Foundation]

- State Tax Collections Per Capita (FY2021) (Rank): 12 [Tax Foundation]

- State-Local Total Tax Burden per Capita (2022) ($): $7,803 [Tax Foundation]

- State-Local Tax Burden per Capita (2022) (%): 10.70% [Tax Foundation]

- State-Local Tax Burden per Capita (2022) (Rank): 30 [Tax Foundation]

- Top Income Tax Rate (2024) (%): 0.00% [Tax Foundation]

- Top Income Tax Rate (2024) (Rank): 1 [Tax Foundation]

- Flat/Progressive/Zero Income Tax (2024): Z [Tax Foundation]

- Overall State Business Tax Climate Index (2024)(Rank): 35 [Tax Foundation]

- Top Corporate Income Tax Rate (2024) (%): 0.00% [Tax Foundation]

- Top Corporate Income Tax Rate (2024) (Rank): 1 [Tax Foundation]

- State-Local Sales Tax Rate (2024) (%): 8.86% [Tax Foundation]

- State-Local Sales Tax Rate (2024) (Rank): 45 [Tax Foundation]

- Property Taxes Paid as a Percentage of Owner-Occupied Housing Value (2021) (%): 0.87% [Tax Foundation]

- Property Taxes Paid as a Percentage of Owner-Occupied Housing Value (2021) (Rank): 29 [Tax Foundation]

- Economic Outlook (2024) (Rank): 37 [American Legislative Exchange Council]

- Economic Performance Rankings, 2012-2022 (2024) (Rank): 8 [American Legislative Exchange Council]

- Tax and Expenditure Limit (0-3): 2 [American Legislative Exchange Council]

- Tax and Expenditure Limit (Rank): 3 [American Legislative Exchange Council]

- Right-to-Work Law (2022) (Y/N): N [American Legislative Exchange Council]

- State-Local Spending per Capita (2022) ($): $16,276 [US Government Spending]

- State-Local Spending per Capita (2022) (Rank): 43 [US Government Spending]

- Official Poverty Rate (2020-22) (%): 8.3 [Census Bureau]

- Official Poverty Rate (2020-22) (Rank): 7 [Census Bureau]

- Supplemental Poverty Rate (2020-22) (%): 7.9 [Census Bureau]

- Supplemental Poverty Rate (2020-22) (Rank): 19 [Census Bureau]

- Labor Force Participation Rate (Dec 2023) (%): 64.30% [Bureau of Labor Statistics]

- Labor Force Participation Rate (Dec 2023) (Rank): 18 [Bureau of Labor Statistics]