Featured Posts

Consumer Affairs, Vaping

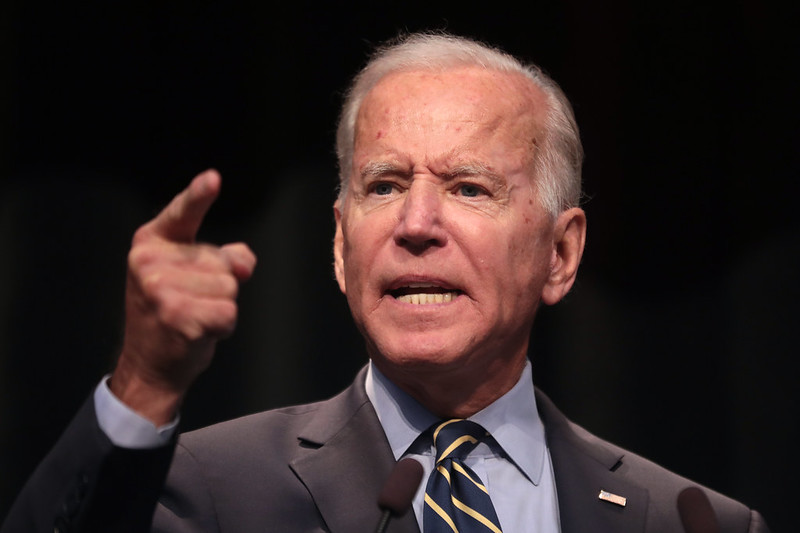

Biden Abandons Disastrous Menthol Prohibition Plan; Now Washington Needs To Embrace Harm Reduction

In a rare recognition of reality, the Biden Administration today finally agreed to drop their deeply flawed plans to introduce prohibition for Menthol cigarettes…

Education

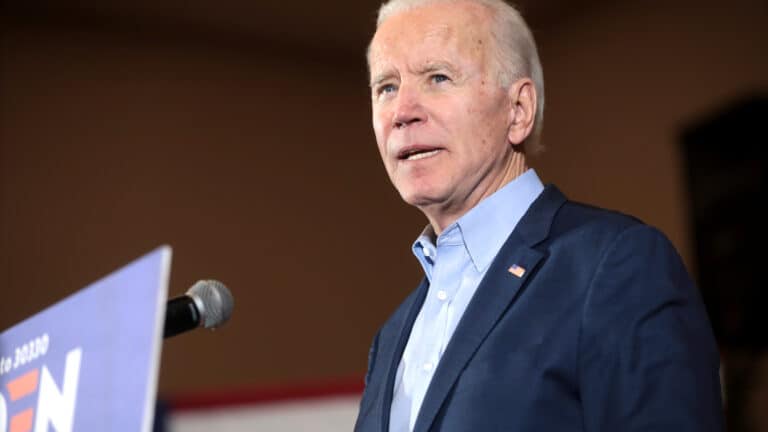

Biden’s Student Loan Cancellation Plan Will Only Worsen a Larger Problem in Higher Education

Last week, President Biden visited Madison, Wisconsin where he announced new details for his student debt cancellation plan. While this initiative promises immediate short-term financial…

Financial Services

ATR Op-Ed in American Banker: “The Fed’s manipulation of debit card interchange fees must stop”

On April 25, 2024, American Banker’s commentary page, BankThink, published an op-ed written by ATR’s director of financial policy, Bryan Bashur. The piece…

Filtered Posts

Regulation, Trade

Three Things To Know About Biden’s Misguided Opposition to Nippon Deal

Regulation, Trade

Five Takeaways from House Judiciary’s Bombshell Report on Lina Khan’s Runaway FTC

Regulation, Trade

Nippon Steel Deal Would Benefit American Workers and Global Competitiveness

Tech & Telecom, Trade

30 Free Market Groups and Activists Oppose Biden’s Surrender on Digital Trade

Trade

USTR Announcement Is A Giveaway To Progressive Activists

Spending & Regulatory Reform

“Swifties” Shouldn’t Trick Republicans Into Empowering Woke FTC

Consumer Affairs

Five Takeaways from Lina Khan’s House Judiciary Testimony

Consumer Affairs

Lina Khan Has Some Explaining To Do

Spending & Regulatory Reform

Klobuchar’s Pet Project Comes Back With A Whimper

Consumer Affairs