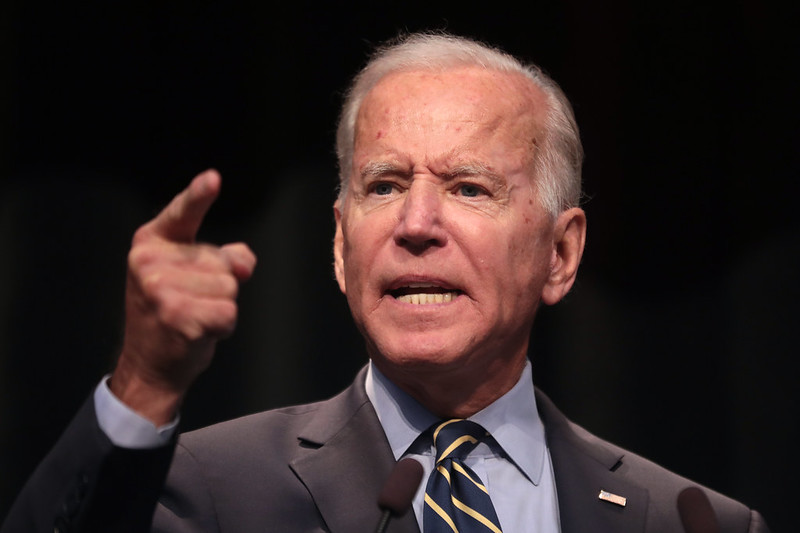

President Joe Biden has come out in opposition to Nippon Steel’s pending acquisition of U.S. Steel, a $14 billion transaction that would bring the iconic American steel company back from the brink of extinction. The transaction is currently under review by the Committee for Foreign Investment in the United States.

If Biden looked at the merits of the Nippon deal, he would understand that it benefits American workers and strengthens the American steel industry both domestically and internationally. Instead, Biden is playing politics in a reelection year.

Here are three things to know about Biden’s opposition to the Nippon deal.

Biden’s Opposition Is A Rebuke of the Trump Tax Cuts

In 2020, Biden campaigned on repealing the Trump tax cuts, vowing to raise your taxes “on day one.”

Nippon is paying $14 billion for U.S. Steel because of free market tax and regulatory policies pursued during the Trump administration, with the Tax Cuts and Jobs Act as the centerpiece. Trump lowered the corporate rate from 35 to 21 percent, bringing the United States right in line with the rest of the developed world. Additionally, there is widespread bipartisan agreement on maintaining tax provisions vital to steel manufacturers – full business expensing, research and development deductibility, and neutral treatment of interest derived from investment debt.

The Trump tax cuts made the United States an attractive environment for foreign direct investment. In stark contrast, Biden wants to raise the corporate rate to 28 percent, higher than Communist China’s 25 percent rate. This is a doubly bad idea given that a primary benefit of Nippon’s acquisition of U.S. Steel would be increased competitiveness with Chinese steel on the global stage.

Biden’s opposition to the Nippon deal is another way for him to continue his vendetta against the Trump tax cuts.

Biden’s Opposition Is Another Deliverable for Big Labor

During his 2020 presidential campaign, Biden promised to be “the most pro-union president you’ve ever seen.” Of course, Biden had no choice – Big Labor spent at least $1.8 billion to elect Democrats in 2020 and just announced $200 million in additional spending for the 2024 campaign.

The United Steelworkers (USW) is vociferously opposed to the deal, coming out with a recent statement “slamming” the deal and “strongly [urging] government regulators to carefully scrutinize this acquisition.” The USW’s opposition is confusing because both Nippon Steel and U.S. Steel have publicly guaranteed that “[a]ll of U.S. Steel’s commitments with its employees, including all collective bargaining agreements in place with its unions, will be honored and NSC is committed to maintaining these relationships uninterrupted.”

The tail is wagging the dog here. We know that Big Labor is influencing Biden’s position because his own aides have publicly signaled that the USW would have final say over whether or not the deal goes through. Ironically, Big Labor’s opposition to the deal is threatening the jobs they claim they are trying to save – shares of U.S. Steel fell as much as 15 percent when word of Biden’s opposition to the deal leaked.

Biden’s opposition to the Nippon deal is just another deliverable for Big Labor’s multi-billion dollar investment in Biden’s reelection and the Democrat party writ large.

Biden Continues to Display Competition Policy Confusion

Throughout his presidency, Biden has fashioned himself as the biggest trust buster since Teddy Roosevelt. Biden will likely raise competition concerns with the Nippon deal to throw sand in the gears of the review process. Ironically, if CFIUS blocks the Nippon deal and U.S. Steel takes its other offer, it could create a near-monopoly on iron ore production in the United States.

Before U.S. Steel accepted Nippon’s all-cash offer, Ohio-based steel manufacturer Cleveland-Cliffs offered to buy the company at $35/share. Biden would likely pressure antitrust regulators to clear the deal as he has repeatedly stressed his desire to keep U.S. Steel under American ownership. If Cleveland-Cliffs were to buy U.S. Steel, it would bring 95% of American iron ore production under the control of one company.

Biden ignores how Nippon’s acquisition would benefit American competitiveness both domestically and internationally. Nippon is not buying U.S. Steel to strip it for parts – the company plans to reinvigorate U.S. Steel with new technologies – including “hydrogen injecting technology into blast furnaces, high grade steel production in large size electric arc furnaces, and hydrogen use in direct iron reduction process.” These innovations, along with Nippon’s substantial investment, will allow U.S. Steel to grow and compete on the global stage.

Biden’s opposition to the Nippon deal is another example of the Biden administration’s tortured logic on competition policy.

Conclusion

Ultimately, CFIUS should ignore Biden’s opposition and proceed with a merit-based review of the Nippon deal. Following the facts would lead CFIUS to conclude that the deal would benefit American workers, grow the economy, and help American steel compete on the global stage.

See also:

Nippon Steel Deal Would Benefit American Workers and Global Competitiveness