Featured Posts

IRS Watch, Tax Reform

ATR supports Senator Thune’s END BYOD Act

Senator John Thune (R-S.D.), the Senate Republican Whip and ranking member of the Subcommittee on Taxation and Internal Revenue Service Oversight, this week…

Labor

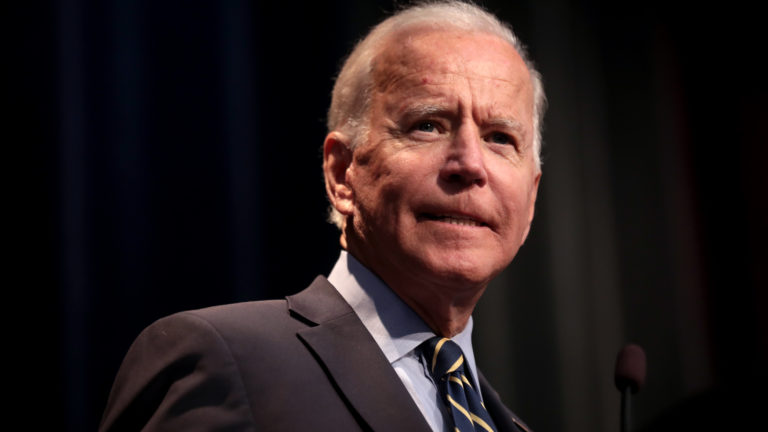

Biden Ends Small Business Week by Weakening Small Business

President Joe Biden marked the end of National Small Business Week by vetoing a resolution that would have protected franchisees and other small businesses.

Labor

Lawmakers Demand Julie Su’s Resignation at May Day Hearing

Members of Congress told Julie Su to resign at a committee hearing on Wednesday amid criticism of her illegitimate tenure, regulatory overreach, and long pattern…

Filtered Posts

Tax Reform

40 Years of Failure: IRS Unable to Fix Computer System

New Zealand Sees Largest Decline in Smoking Ever Recorded Thanks to E-Cigarettes

Tax Reform

Crapo: IRS Has “Not provided any substantive response” Regarding Stolen Taxpayer Files

Consumer Affairs

How Sweet it is; Study Finds Flavored Vapes Divert Young People from Smoking

Consumer Affairs

Study Suggests Tobacco Heating Products Reduce Risk of Lung Cancer, Cardiovascular Disease

Tax Reform

Reconciliation Bill Gives Special Tax Handout to Big Media

Consumer Affairs, Healthcare

Up in Smoke: New Study Highlights Perils of Banning Flavored E-Cigarettes

Tax Reform

Tax Policy Center: Tax on Unrealized Gains “Ripe for Abuse” and “Won’t Work”

Tax Reform

Dems Want IRS to Snoop on Your Bank Account: “There would be no meaningful financial privacy for individuals or businesses if this goes through.”

Tax Reform