Featured Posts

List of 10 Current Postal Service Failures

The U.S. Postal Service Board of Governors, the regulator of the U.S. Postal Service, will meet Thursday as USPS leadership faces growing pushback over its…

Tax Reform

Oklahoma Can Cut Income Taxes and Accommodate Senate’s Disagreement

Oklahoma’s House and Senate are still in a heated battle over the budget, primarily disagreeing over further slashing the state’s income tax. That was a…

Consumer Affairs, Energy

ATR Supports the “Hands Off Our Home Appliances Act”

Americans for Tax Reform urges members of Congress to vote “YES” on H.R. 6192, the Hands Off Our Home Appliances Act.

Filtered Posts

Criminal Justice

North Carolina Economy Loses $685 Million Due to Driver’s License Suspensions over Debt

Tax Reform

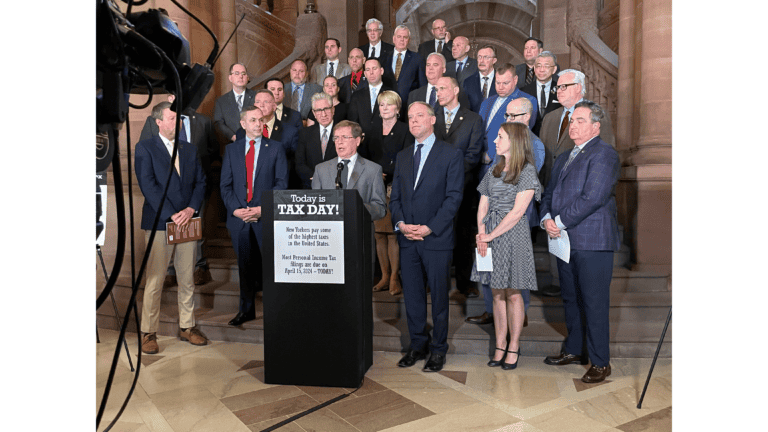

Tax Day in New York: Grover Norquist Joins Legislative Leaders in Hammering State’s Crushing Tax Burden

Spending & Regulatory Reform, Tax Reform

New Jersey Governor Phil Murphy Betrays No Tax Increase Promise, Returns to Tax-and-Spend Ways

Criminal Justice

Missouri Closing in on Boosting Workforce, Public Safety with Clean Slate Legislation

Criminal Justice

Missouri Amendment Would Bring Twisted Incentives to Sheriff Pensions

Tax Reform

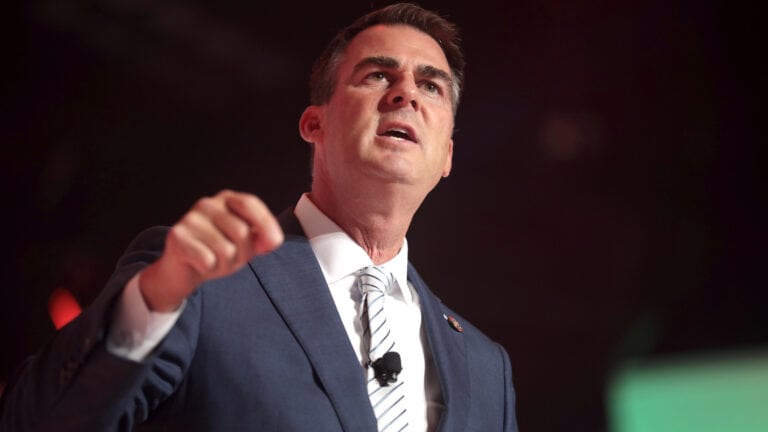

Big Win: Income Tax Elimination Plan Approved by Oklahoma House

Tax Reform

Oklahoma State of the State: Cut Taxes, Contain Spending to Keep Prosperity & Growth Going

Criminal Justice

Hearing on First Step Act Is a Reminder It’s Working

Criminal Justice

Signed, Sealed, Delivered: Pennsylvania Clean Slate 3.0 Enacted

Energy