Featured Posts

Education

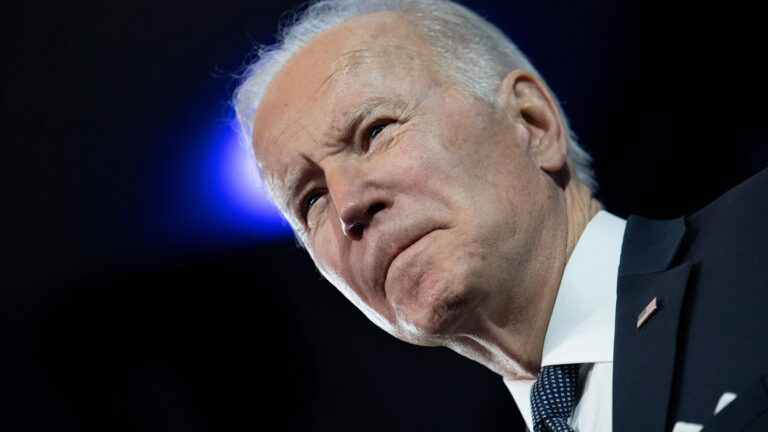

Biden’s Student Loan Cancellation Plan Will Only Worsen a Larger Problem in Higher Education

Last week, President Biden visited Madison, Wisconsin where he announced new details for his student debt cancellation plan. While this initiative promises immediate short-term financial…

Financial Services

ATR Op-Ed in American Banker: “The Fed’s manipulation of debit card interchange fees must stop”

On April 25, 2024, American Banker’s commentary page, BankThink, published an op-ed written by ATR’s director of financial policy, Bryan Bashur. The piece…

Spending & Regulatory Reform, Tax Reform

Worst of Both Worlds: U.S. Economic Growth Slows as Inflation Rates Rise

Today, the Commerce Department released a snapshot of its growth report for the first quarter. The country’s gross domestic product (GDP) grew by just…

Filtered Posts

Tax Reform

Senate Democrats Pushing $250B Small Business Tax Hike

Healthcare, Spending & Regulatory Reform

Senators Should Oppose the Pharmacy Benefit Manager Transparency Act

Tax Reform

Five Tax Cuts in the RSC Budget That Will Grow the Economy and Help the Middle Class

Spending & Regulatory Reform, Tax Reform

Biden Admin Policies Will Harm, Not Help Inflation

Tax Reform

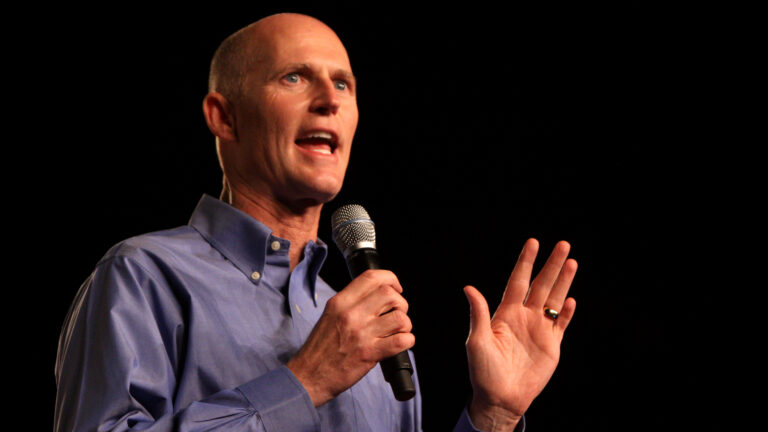

Five Reasons Conservatives Should Oppose Sen. Rick Scott’s “Skin in the Game” Tax Hike

Tax Reform

Ten Reasons to be Concerned with Biden’s 20 Percent Tax on Unrealized Gains

Tax Reform

IRS Data: Trump Tax Cuts Benefited Indiana Middle Class Taxpayers

Spending & Regulatory Reform

Manchin’s Call to Repeal Trump Tax Cuts Will Harm West Virginians

Tax Reform

House Dems Should Not Force Vote on Socialist Tax and Spend Bill Without CBO Score

Healthcare, Tax Reform