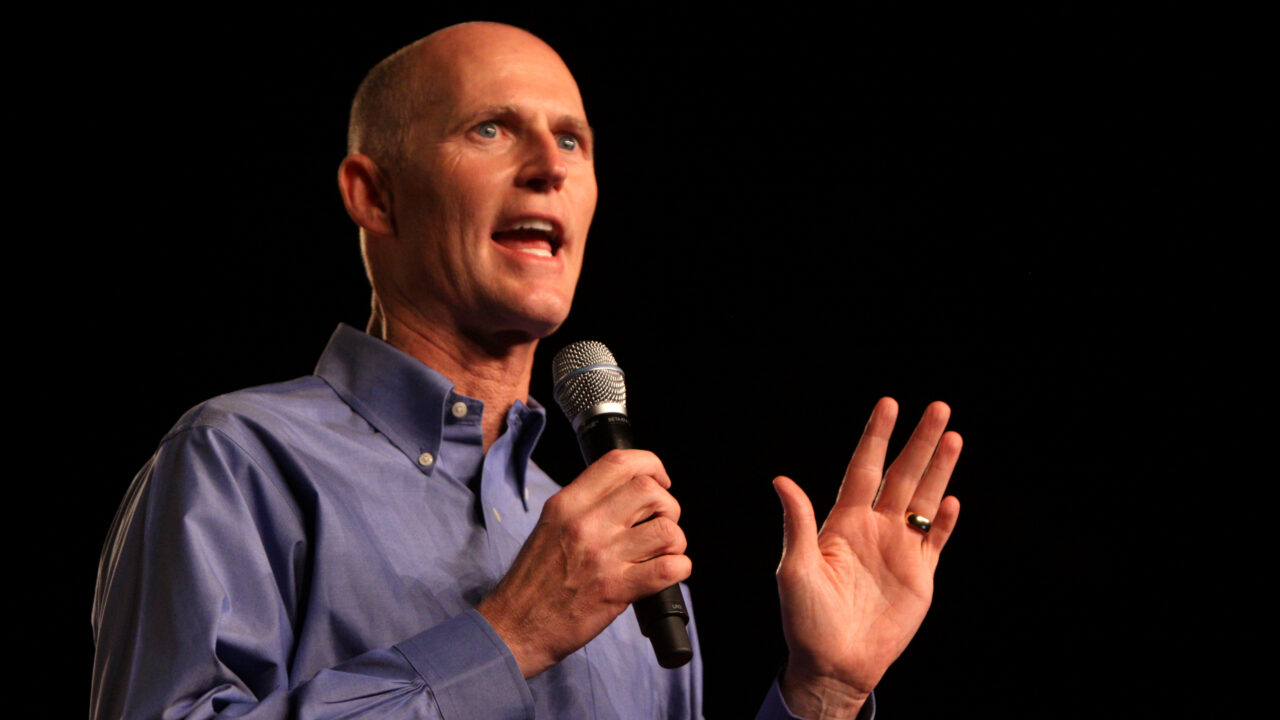

"Rick Scott" by Gage Skidmore is licensed under CC BY-SA 2.0. https://flic.kr/p/aqsGdP

"Rick Scott" by Gage Skidmore is licensed under CC BY-SA 2.0. https://flic.kr/p/aqsGdP

Senator Rick Scott (R-Fla.) has a terrible idea to make half of the country pay more in federal income taxes.

Senator Scott released this proposal as one of roughly 120 proposals in his “Rescue America” plan. While supporters of the plan say that those criticizing his plan are using left-wing talking points, his proposal is clear – he explicitly states that half of the country does not pay federal income taxes and calls for them to be taxed so they have “skin in the game.”

Here are five reasons conservatives should be concerned with this proposal:

1. The Proposal is based on flawed logic – everyone pays some kind of tax

There are many reasons a taxpayer may not make enough to pay any federal income tax in a year – for instance, they may be taking time off in order to be a caretaker for an elderly relative or to study.

Income taxes are just one of many ways a person pays taxes. Americans pay payroll taxes including the 6.2 percent Social Security tax and the 1.45 percent Medicare tax.

They pay taxes on capital gains and dividends. They pay sales taxes on the purchase of many goods and services and pay taxes when purchasing gasoline. They pay excise taxes on the purchase of alcohol and tobacco.

Americans are also impacted by the corporate tax. According to the Tax Foundation, 70 percent of the corporate tax falls on labor (or workers). All Americans also pay the corporate tax built-in to the price of goods and services.

Senator Scott has since said he doesn’t want to tax seniors that do not pay income tax and his proposal is meant to hit those taking advantage of federal subsidies and other payments.

However, that is not what the plan says. In addition, the more loopholes and conditions added to this tax, the more the IRS would be empowered to insert itself into the lives of Americans.

2. The Proposal Undermines the Trump Tax Cuts

Senator Scott’s plan is fundamentally at odds with the Trump Tax Cuts, also known as the Tax Cuts and Jobs Act (TCJA). The TCJA reduced tax brackets, doubled the standard deduction from $12,000 to $24,000 for a family, and doubled the child tax credit from $1,000 to $2,000.

This law saw strong tax reductions for Americans across the country and even zeroed out tax liability for some. In fact, the number of filers with tax liability dropped by 3.7 million, according to 2017 and 2018 IRS Statistics of Income data.

3. The Proposal is a Political Gift to High Tax Dems

Republicans have established themselves as the party of lower taxes, while Democrat are the party of higher taxes and tax increases. Politically, this proposal is a gift for high-tax Democrats that support big government and socialist policies. In fact, Democrats have already begun running attack ads arguing that Republicans want to raise taxes on half the country.

While this is inaccurate, Senator Scott currently leads the National Republican Senatorial Committee (NRSC), which plays a leading role in electing Senate Republicans.

In addition, this plan undermines opposition to tax increases proposed in the Democrat’s “Build Back Better Act.” This law includes an $800 billion tax increases on corporations based on the same flawed “fair share” premise. The proposal includes a 15 percent domestic minimum tax championed by Senator Elizabeth Warren and a 15 percent global minimum tax.

4. There are No Shortage of Tax Proposals for Conservatives to Push

It is unfortunate that this is the only tax proposal in Senator Scott’s plan, when there is no shortage of tax policies that Republican lawmakers should be looking to get enacted into law.

For instance, they can make permanent the Trump tax cuts, which are set to expire at the end of 2025. They can expand tax advantaged savings accounts like 401(k)s, IRAs and HSAs. They can also help encourage economic growth by creating new incentives for businesses to invest through the R&D tax credit and immediate expensing.

5. The Proposal Undermines Efforts to Cut State Taxes

In addition, this undermines progress made in the states by GOP lawmakers. Currently, eight states, including Florida, have no income tax and a dozen others are moving toward this goal. This pattern is seeing taxpayers move from high tax, blue states to low tax, red states.

However, under Sen. Scott’s logic, phasing out income taxes would be a bad thing because taxpayers “have no skin the game.”

Senator Scott has been a leader in cutting taxes in the past. He cut taxes every year as Governor and has supported tax cuts while serving as Senator.

However, his proposal to raise federal income taxes on as much as half of the country undermines this leadership and efforts to make the Trump tax cuts permanent. It is based on the flawed premise that taxpayers should “pay their fair share,” and represents a gift to Democrats that routinely utilize this rhetoric in an effort to have higher taxes and bigger government.