CBO budget numbers confirm that the Simpson-Bowles budget proposed by some members of Congress would not have reined in the nation’s spending problem as its supporters claimed. The proposal that was adopted in its place, the Budget Control Act (BCA) succeeded in reducing spending at far greater levels than Simpson-Bowles would have.

President Obama commissioned the “National Commission on Fiscal Responsibility and Reform” led by co-chairs Alan Simpson and Erskine Bowles. In late 2010, the commission released its budget blueprint, often described as the Simpson-Bowles budget.

Ultimately, the proposal was ignored by Congress because it was a $3.3 trillion tax increase, and did not adequately address the nation’s spending problem. Instead, the Republican controlled Congress chose to pass the BCA, which implemented annual spending caps to limit the growth of spending. This was enforced by across the board sequesters on federal spending and helped direct the federal budget towards a pathway of responsible spending.

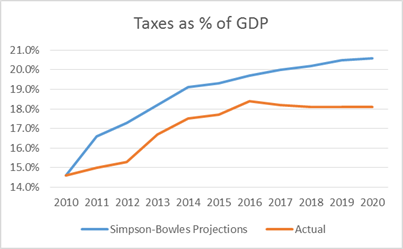

The Simpson-Bowles budget proposed reducing federal debt and spending by raising taxes. At the time, the commission’s own forecast predicted a $1 trillion tax increase over 10 years, but in hindsight the plan would have raised taxes by $3.264 trillion over 10 years. Under Simpson-Bowles, taxes would currently be 19.3 percentage of GDP and a projected 20.6 percentage of GDP by 2020. But under BCA current law, taxes have been kept at a far lower 17.7 percent of GDP and will reach just 18.1 percent of GDP – 2.5 percent lower than Simpson-Bowles, equating to $435 billion less in taxes.

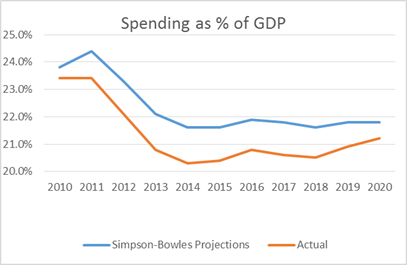

Simpson-Bowles proposed a trade-off: tax increases for spending cuts. But based on CBO statistics, the BCA-imposed spending restraint has done everything Simpson-Bowles promised and more, all without drastically increasing taxes on American families. According to CBO, spending as a percentage of GDP currently sits at 20.4 percent, far lower than the 21.6 percent that Simpson-Bowles touted.

Even though Simpson-Bowles would have been an abject failure, some politicians continue to support the framework. Senator Lindsey Graham (R-S.C.), a candidate for President of the United States recently called on Congress to pass the budget plan during an interview on CNN’s “State of the Union.”

In reality, the high taxes that Simpson-Bowles called for were never needed and would have raised the tax burden on American families and businesses to near record high levels.