Senator Lindsey Graham (R-S.C.), a candidate for President of the United States, recently called on Congress to pass the Simpson-Bowles budget plan during an interview on CNN’s “State of the Union.” Simpson-Bowles would raise taxes by as much as $3.3 trillion over ten years, but has failed to gain traction in Congress since being released in 2010.

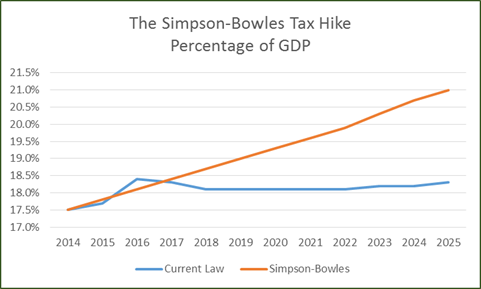

If Senator Graham has his way, taxes will be $3.264 trillion higher over the next ten years, and already-overtaxed businesses and families will be taxed a total of $5.8 trillion in 2025. Under current law, taxes as a percentage of GDP are projected to reach 18.3 percent by 2025. But if Simpson-Bowles goes into effect, taxes as a percentage of GDP will spike to 21 percent.

Senator Graham’s support for Simpson-Bowles places him at odds with rival GOP Presidential candidates, many of whom have come out against new tax hikes. Already, a number of Graham’s rivals have made firm commitments not to raise taxes if elected President. This list includes Senators Rand Paul, Ted Cruz, and Marco Rubio; Former Governors Mike Huckabee, and Rick Perry; Former Senator Rick Santorum, and Carly Fiorina.