Featured Posts

Education

Biden’s Student Loan Cancellation Plan Will Only Worsen a Larger Problem in Higher Education

Last week, President Biden visited Madison, Wisconsin where he announced new details for his student debt cancellation plan. While this initiative promises immediate short-term financial…

Financial Services

ATR Op-Ed in American Banker: “The Fed’s manipulation of debit card interchange fees must stop”

On April 25, 2024, American Banker’s commentary page, BankThink, published an op-ed written by ATR’s director of financial policy, Bryan Bashur. The piece…

Spending & Regulatory Reform, Tax Reform

Worst of Both Worlds: U.S. Economic Growth Slows as Inflation Rates Rise

Today, the Commerce Department released a snapshot of its growth report for the first quarter. The country’s gross domestic product (GDP) grew by just…

Filtered Posts

ATR Applauds Governor Ron DeSantis for Vetoing Flavored Vaping Ban

California’s Assault Against Ride-Sharing Services Shows Why National Preemption Necessary to Save the Gig Economy

Where Do the 2020 Democrats Stand on Vaping?

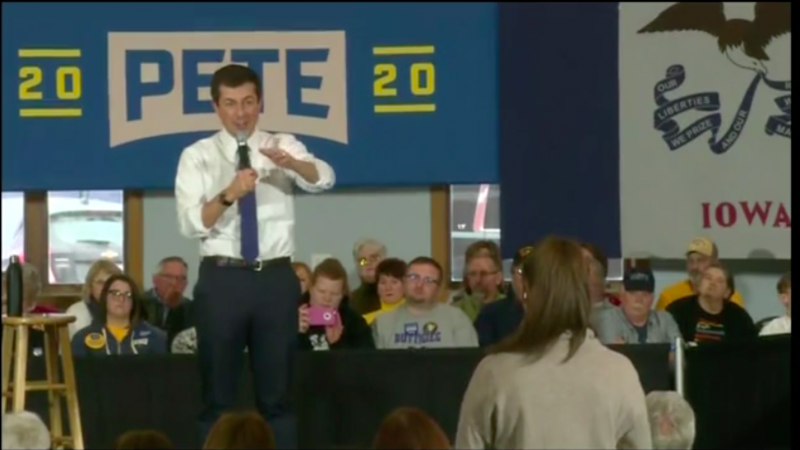

Pete Buttigieg Confuses Marijuana With Nicotine and Signals He’d Impose Harsher Regulations on Vaping

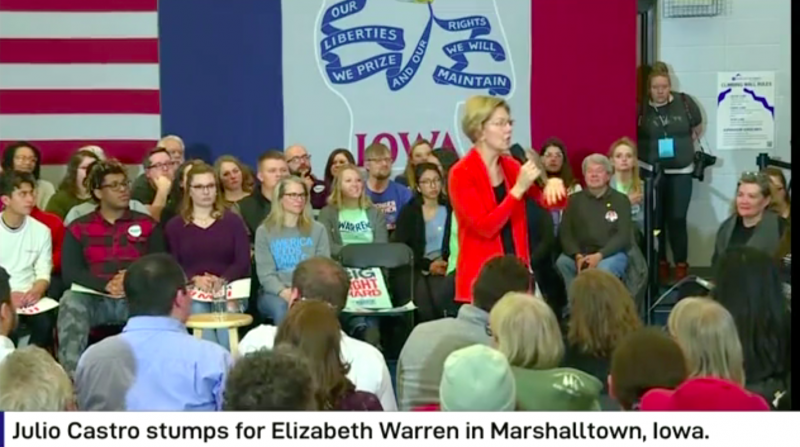

Elizabeth Warren’s Anti-Vaping Extremism Ignores Benefit of Vaping for Adult Smokers

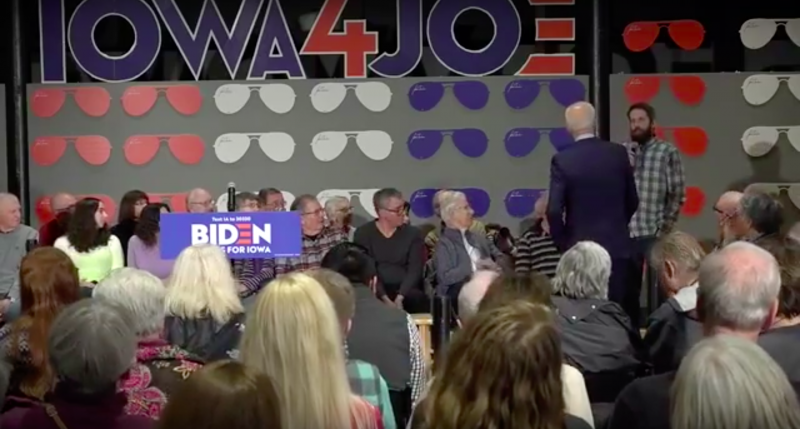

Joe Biden Suggests He Would “Eliminate” Vaping If Elected

FDA’s Decision to Ban Some Vapor Products is a Compromise But Not a Complete Victory

Morning Consult Poll of Trump Voters: “Flavor Ban Could Cost Him Tenth of His Voters”

Congress Should Reject Additional Online Sales Restrictions for Adults Who Buy E-Cigarettes