Featured Posts

Tax Reform

Yellen Feigns Ignorance of Biden Vow to End the Trump Tax Cuts

Biden said Trump-enacted tax cuts “are going to stay expired and dead forever if I’m re-elected.” In a House Ways and Means Committee…

Tax Reform

Questions for Yellen Ahead of Ways and Means Hearing

Biden tax increases: President Biden last week said twice that he would let the entire Tax Cuts and Jobs Act expire and die if…

Tax Reform

Congestion Tax Highly Unpopular in New York

An overwhelming majority of New York voters oppose the new $15 “congestion toll” that is set to take effect in June. According to…

Filtered Posts

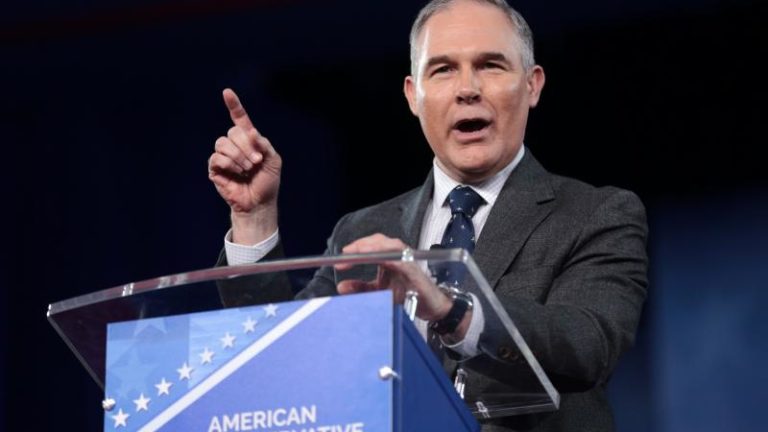

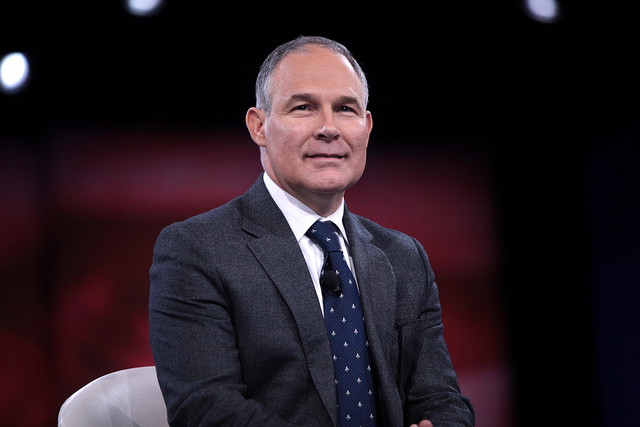

ATR Supports EPA Administrator Pruitt’s Work to Rein In RFS

ATR Support Rep. Mullin’s Amendments on Methane and Social Cost of Carbon

ATR Applauds Secretary Zinke’s Efforts to Improve Antiquities Act Designations

ATR Joins Coalition Calling on Congress to Repeal CFPB Arbitration Rule

ATR Opposes PFC Increase in THUD Appropriations Act

Happy Birthday Dodd-Frank…Hope It’s Your Last!

ATR Applauds Pruitt EPA for Moving to Rescind WOTUS

ATR Urges Senate Lawmakers to Oppose PFC Increase

ATR Urges Support for Davis-Cohen Airport Tax Amendment to House FAA Bill