Featured Posts

Consumer Affairs, Energy

ATR Supports the “Hands Off Our Home Appliances Act”

Americans for Tax Reform urges members of Congress to vote “YES” on H.R. 6192, the Hands Off Our Home Appliances Act.

Labor

Julie Su Subpoenaed Again After Failure to Comply with House Committee

Biden’s Acting Secretary of Labor Julie Su is facing yet another subpoena from the House Education & Workforce Committee after failing to provide timely answers…

IRS Watch, Tax Reform

ATR supports Senator Thune’s END BYOD Act

Senator John Thune (R-S.D.), the Senate Republican Whip and ranking member of the Subcommittee on Taxation and Internal Revenue Service Oversight, this week…

Filtered Posts

Joe Biden Will Raise Your Taxes

Tax Reform

Biden: Tax cuts “are going to stay expired and dead forever if I’m re-elected.”

Tax Reform

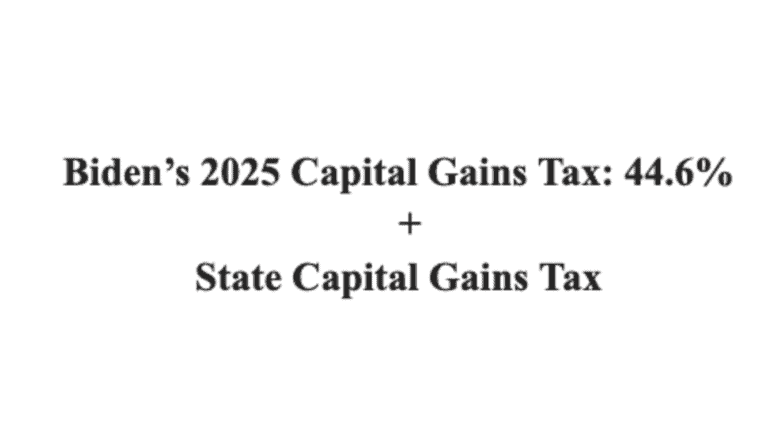

Biden Calls for 44.6% Capital Gains Tax Rate, Highest Capital Gains Tax Since Its Creation in 1922

Due to Biden’s Inflation, His $400,000 Tax Pledge Now Worth Only $335,000

Beware a Carbon Tax If Biden Wins a Second Term

Tax Reform

Biden’s $400k Tax Pledge Now Only Worth $337k

Spending & Regulatory Reform

Biden Budget Deploys 50,000-Person Green New Deal Youth Patrol

Tax Reform

SOTU: Biden Will Lie About GOP Tax Cuts, Again

IRS Watch, Tax Reform

Norquist Warns of the Privacy Risk of IRS “Bring Your Own Device” Program

IRS Watch, Tax Reform