And don’t forget to add the state capital gains tax: the Biden combined federal-state rate would exceed 50% in many states

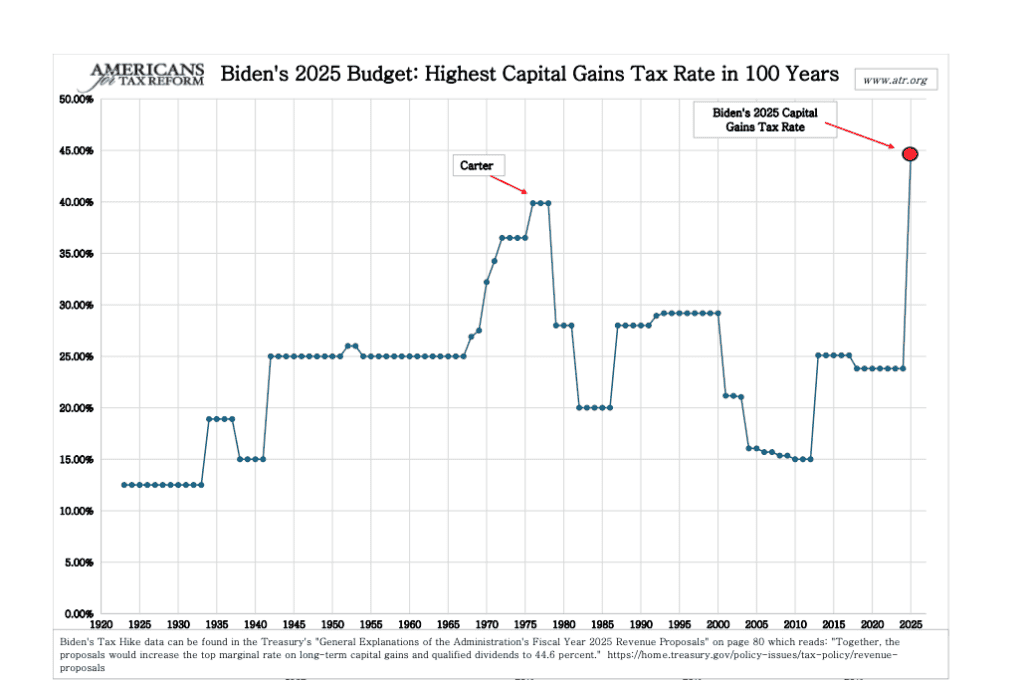

President Biden has formally proposed the highest top capital gains tax in over 100 years.

Here is a direct quote from the Biden 2025 budget proposal: “Together, the proposals would increase the top marginal rate on long-term capital gains and qualified dividends to 44.6 percent.”

Yes, you read that correctly: A Biden top capital gains and dividends tax rate of 44.6%.

Under the Biden proposal, the combined federal-state capital gains tax exceeds 50% in many states. California will face a combined federal-state rate of 59%, New Jersey 55.3%, Oregon at 54.5%, Minnesota at 54.4%, and New York state at 53.4%.

Worse, capital gains are not indexed to inflation. So Americans already get stuck paying tax on some “gains” that are not real. It is a tax on inflation, something created by Washington and then taxed by Washington. Biden’s high inflation makes this especially painful.

Many hard working couples who started a small business at age 25 who now wish to sell the business at age 65 will face the Biden proposed 44.6% top rate, plus state capital gains taxes. And much of that “gain” isn’t real due to inflation. But they’ll owe tax on it.

Capital gains taxes are often a form of double taxation. When capital gains come from stocks, stock mutual funds, or stock ETFs, the capital gains tax is a cascaded second layer of tax on top of the current federal corporate income tax of 21%. (Biden has also proposed a corporate income tax hike to 28%).

Join ATR

The proposed Biden top capital gains tax rate is more than twice as high as China’s rate. China’s capital gains tax rate is 20%. Is it wise to have higher taxes than China? And with Biden’s combined federal-state capital gains rate of 59% in California, residents will face a rate nearly three times as high as China.

The capital gains tax was created as its own tax in 1922, at a rate of 12.5%. See the chart below to see how Biden’s proposed capital gains tax for 2025 puts the United States in uncharted territory.

Biden’s proposed capital gains tax hike will also hit many families when parents pass away. Biden has proposed adding a second Death Tax (separate from and in addition to the existing Death Tax) by taking away stepped-up basis when parents die. This would result in a mandatory capital gains tax at death — a forced realization event.

As previously reported by CNBC:

“When someone dies and the asset transfers to an heir, that transfer itself will be a taxable event, and the estate is required to pay taxes on the gains as if they sold the asset,” said Howard Gleckman, senior fellow in the Urban-Brookings Tax Policy Center.

Biden’s proposal to take away stepped-up basis has already been tried, and it failed: In 1976 congress eliminated stepped-up basis but it was so complicated and unworkable it was repealed before it took effect.

As noted in a July 3, 1979 New York Times article, it was “impossibly unworkable.”

NYT wrote:

“Almost immediately, however, the new law touched off a flood of complaints as unfair and impossibly unworkable. So many, in fact, that last year Congress retroactively delayed the law’s effective date until 1980 while it struggled again with the issue.“

As noted by the NYT, intense voter blowback ensued:

“Not only were there protests from people who expected the tax to fall on them — family businesses and farms, in particular — bankers and estate lawyers also complained that the rule was a nightmare of paperwork.“

Biden’s 2025 budget calls for about $5 trillion in tax increases over the next decade.

Follow the author on Twitter @JohnKartch

To learn more about Biden’s many tax increases, visit ATR.org/HighTaxJoe

Click here for a printable PDF of the Capital Gains Chart