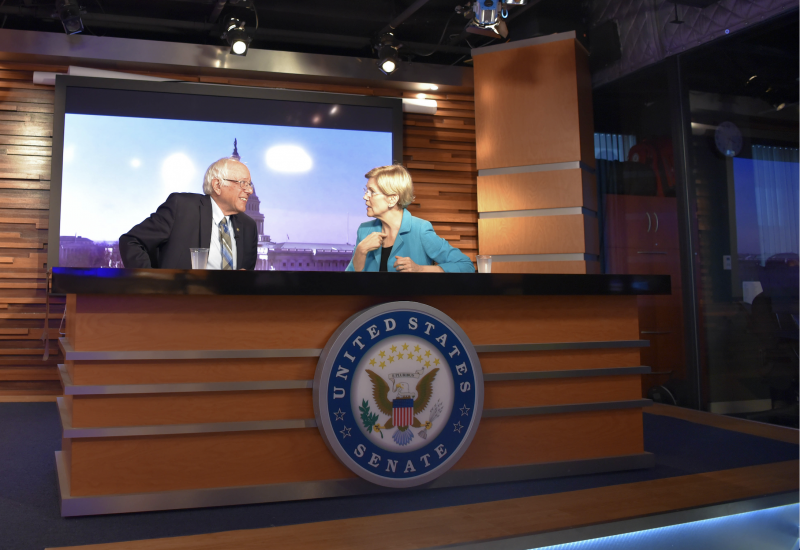

2020 Democrat presidential candidates Elizabeth Warren and Bernie Sanders have proposed a wealth tax to fund a wish list of socialist priorities like socialized medicine and free college tuition.

Warren plans to tax wealth above $50 million at 2 percent and above $1 billion at 6 percent. Sanders’ plan has more tiers, ranging from 1 percent on wealth above $32 billion to 8 percent over $10 billion. This tax diverges from the existing income tax-based system by imposing a tax annually on all assets.

A wealth tax would double the size of the IRS, increase taxes on thousands of American families, stunt economic growth, and has failed everywhere it has been tried.

Warren’s plan would directly raise taxes on approximately 75,000 families, and Sanders’ plan would raise taxes on 180,000. Sanders estimates that his wealth tax would raise $4 trillion over a 10-year period, while the Warren plan estimates $3.7 trillion. According to estimates by professors Summers and Sarin, however, Warren’s plan would only raise 12 to 40 percent of the $3.7 trillion.

Although a wealth tax is nominally imposed on “the rich,” a recent American Action Forum study shows that the tax will decrease innovation and investment, driving down wages and jobs. Over the long run, the tax will impose an effective tax of up to 63 cents on workers for every dollar of revenue raised.

Further, the wealth tax would shrink GDP by $1.1 trillion over the first ten years, and then continue to shrink it each year by $283 billion (in 2018 US dollars), or 1 percent of GDP. In a $21 trillion economy, this quickly adds up.

While a wealth tax would be detrimental to the economy, it is not even clear how it can be implemented. The IRS would be responsible for keeping track of all assets, which is invasive, expensive, and difficult. The IRS would need to pick a date to value assets, as they may change or be gifted to others throughout the year. This would require a significant increase in resources – one analysis estimates that Warren’s wealth tax would require $5 billion in new spending, the equivalent of 80,800 more full-time IRS agents.

The wealth tax has already failed overseas. In 1995, 15 countries had a wealth tax, 11 of which failed and were repealed. The countries that repealed the tax cited expensive compliance costs, distorted savings and investment, and difficulty valuing non-liquid assets as reasons for repeal. The tax was ineffective at combating wealth insecurity and did not redistribute wealth in favor of low-to-middle income earners.

Austria cited the enormous cost of valuing assets as its primary reason for getting rid of the tax, while Germany declared the tax unconstitutional, an issue that is still in question in America.

France, the most recent country to abandon the tax, actually lost €7.5 billion ($8.32 billion) due to the decline in investment and the exit of 12,000 taxpayers each year. France’s story displays perhaps the strongest argument against wealth taxes – they don’t work.

Historically, “tax the rich” proposals have a way of trickling down to the middle class. In 1969, the Johnson administration leaked that 155 wealthy Americans paid nothing in taxes. Congress created the Alternative Minimum Tax, then referred to as “the millionaire’s tax,” to prevent this small group from future evasion. However, the base for this tax continued to grow each year. By 2011, 5.2 million middle-class Americans were subject to the AMT and it was projected to hit 30 million taxpayers by 2012.

Clearly, a wealth tax will harm Americans in the short and long-term. Warren and Sanders’ proposals will slow GDP growth, innovation, and investment. This would be difficult and costly to implement and has been unsuccessful everywhere it has been tried.