With congressional Democrats under considerable pressure to find new ways to pay for additions to the Build Back Better Boondoggle, such as a $400 billion tax cut for the ultra-wealthy elite and taxpayer funded paid parental leave, concern is building amongst public health experts that they will attempt to bring back the tax on reduced risk tobacco alternatives to try to make up the difference.

Initially proposed in the $3.5 trillion reconciliation package, the highly regressive proposal, which would have taxed reduced risk tobacco alternatives MORE than their combustible counterparts, was dropped after considerable public outcry for violating President Biden’s pledge to not increase taxes on persons earning under $400,000, as well as economic modeling showing it would increase the number of smokers in the US by 2.75 million.

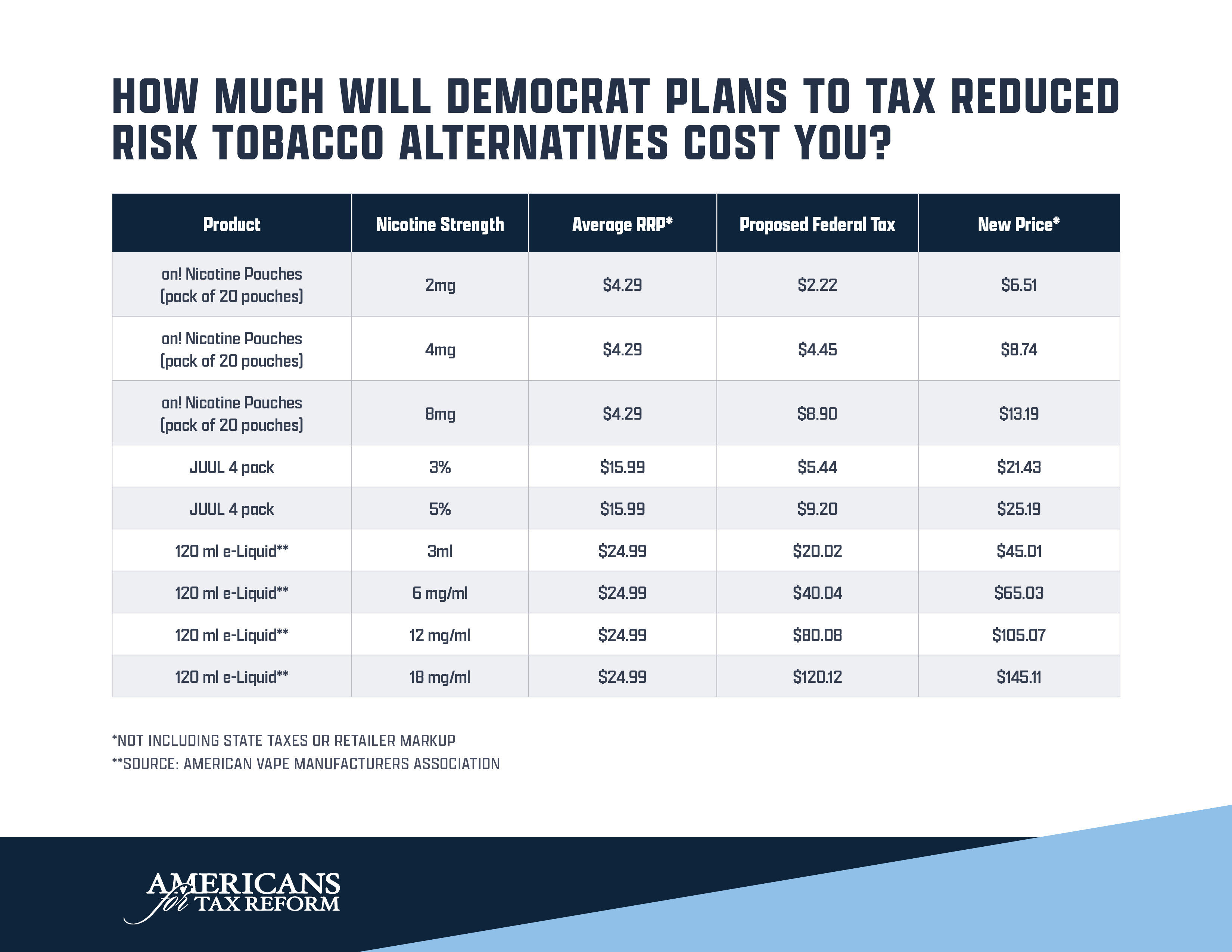

However, many vapers still didn’t understand just how much this tax increase would have cost them. With rumors this destructive tax would be resuscitated, ATR compiled this chart to show exactly how much some products would go up in price, and how it would make many of them essentially impossible for smokers wanting to quit to afford. Please note also these are conservative estimates, and for the sake of clarity and simplicity do not include a 16.7 retailer markup nor state taxes (which can be as high as 95% of state wholesale price)

Despite this tax not being in the Build Back Better framework at present, it is absolutely vital that vapers continue to let Congress know that under no circumstances should this deadly new tax be brought back to pay for SALT deduction tax cuts for the ultra rich.

Despite this tax not being in the Build Back Better framework at present, it is absolutely vital that vapers continue to let Congress know that under no circumstances should this deadly new tax be brought back to pay for SALT deduction tax cuts for the ultra rich.