Ways and Means Republicans are introducing a bill to help businesses reopen by encouraging them to provide testing, personal protection equipment (PPE), and cleaning to workspaces.

The Coronavirus pandemic has created substantial economic damage, as governments across the country have shut down businesses and forced Americans into self-isolation to mitigate the spread of the virus.

While some businesses are beginning to gradually and safely reopen, many businesses including those in the hospitality, airline, and retail industries are still facing a slowdown in commerce that restricts cashflow and threatens their ability to retain jobs.

In order to keep customers and employees safe, businesses must also now grapple with new challenges. For instance, they must ensure employees have regular COVID-19 testing, provide an adequate supply of PPE, conduct extra cleaning, and reconfigure workspaces.

In normal times, this would be time consuming and expensive. Today, these costs can be the difference between a business being able to reopen and being forced to stay closed.

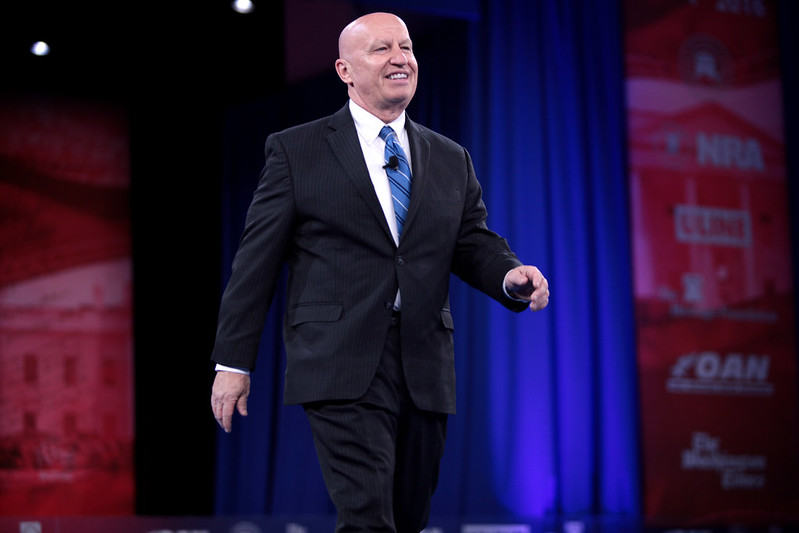

To address this problem, Ways and Means Republicans, led by Ranking Member Kevin Brady (R-Texas) and Rep. Tom Rice (R-SC) are releasing the Healthy Workplace Tax Credit Act.

The legislation provides a tax credit that can be taken against payroll taxes for up to 50 percent of the costs incurred for COVID-19 testing, purchasing PPE, and reconfiguring, disinfecting, and cleaning the workspace.

The credit is limited to $1,000 per employee for a business’s first 1000 employees, $750 per employee for the next 500 employees, and $500 for each additional employee.

While the economy has posted strong job gains over the past two months with millions of Americans going back to work, millions more are still out of a job and the unemployment rate remains in the double digits at 11 percent. Clearly, more needs to be done.

The Healthy Workplace Tax Credit Act will help address the vitally important issue of workplace testing and safety, removing a barrier for businesses to reopen and workers to go back to their jobs.

The legislation is also a more targeted, timely, and realistic proposal than the proposals put forth by Democrats, which call for trillions of dollars in new spending at a time when the deficit is higher than it has ever been.

Leaders in the House, Senate, and Administration are debating the contents and timing of a forthcoming COVID-19 relief package. As these discussions continue, lawmakers should be sure to include the Healthy Workplace Tax Credit Act in any broader proposal.