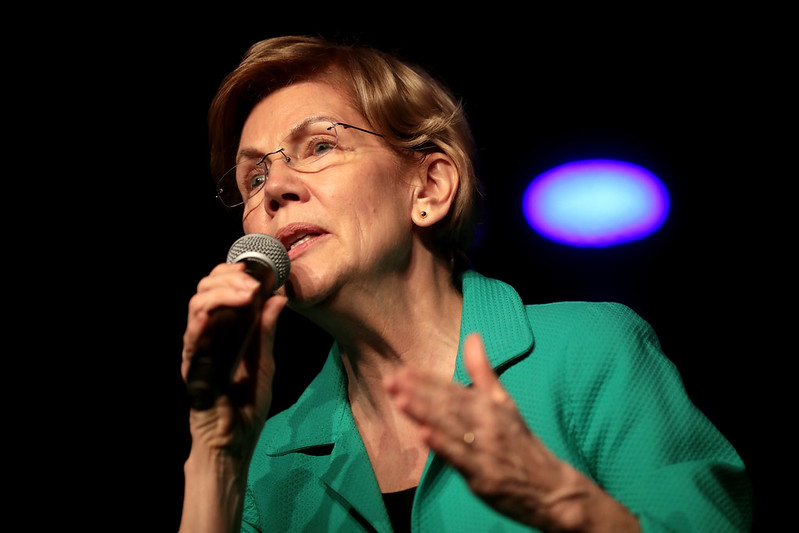

Senator Elizabeth Warren’s (D-Mass.) legislation to impose a $3 trillion wealth tax would give the IRS $100 billion in additional funding over the next 10 years. This would double the size of the IRS.

If just a fraction of this new funding was spent on new IRS employees, it could lead to tens of thousands of new agents and auditors.

Warren’s proposal would disproportionately increase funding for “enforcement,” which includes funding for audits and criminal investigations, instead of “taxpayers services,” which includes funding for taxpayer advocacy, assistance, and education.

This new funding can be found on page 14 of Sen. Warren’s legislation:

SEC. 4. INTERNAL REVENUE SERVICE FUNDING.

(a) IN GENERAL.—Subchapter A of chapter 80 of the 15 Internal Revenue Code of 1986 is amended by adding at the end the following new section:

SEC. 7813. AUTHORIZATION OF APPROPRIATIONS.

‘There are authorized to be appropriated to the Secretary for fiscal years 2022 through 2032—

(1) for enforcement of this title, $70,000,000,000

(2) for taxpayer services, $10,000,000,000

(3) for business system modernization, $20,000,000,000.

According to the Bureau of Labor Statistics, the median pay of a “Tax Examiners and Collectors, and Revenue Agents” is $54,890 per year. If even $5 billion of Warren’s $100 billion in funding was used to hire new IRS workers, it would more than double the size of the agency and add more than 80,000 new government bureaucrats.

Warren’s wealth tax would also impose a 40 percent exit tax on any American that renounces their citizenship with net worth over $50 million. It would take aim at Americans living overseas by expanding tax penalties and reporting requirements that exist under the Foreign Account Tax Compliance Act (FATCA). Even the Washington Post editorial board said this arrangement “conveys a certain authoritarian odor,” as it binds people to the United States with severe financial consequences for deciding to leave.

Several countries have repealed their wealth taxes because of the numerous problems associated with them. In 1995, 15 countries had a wealth tax, 11 of which failed and were repealed. The countries that have repealed their wealth taxes are Sweden, Denmark, the Netherlands, Austria, Finland, France, Germany, Iceland, Luxembourg, Ireland, and Italy. In addition to cost of enforcement, which Austria cited specifically, and the difficulty of valuing assets, these countries also found that the tax was ineffective at combating wealth insecurity.

The wealth tax is also wholly unconstitutional. Article 1, Section 9, Clause 4 states: “No Capitation, or other direct, Tax shall be laid, unless in Proportion to the Census or Enumeration herein before directed to be taken.”

It is abundantly clear that a wealth tax is a direct tax. Federalist No. 36 explained that taxes on “houses and lands” were direct taxes. Supreme Court majorities have said on at least seven occasions that federal taxes on real property are “direct taxes.” With this condition in mind, it is also clear that Warren’s plan would not be apportioned based on state population, making it inconsistent with Article 1, Section 9.

Next, the wealth tax may become the next tax that begins by hitting “the rich” and ends up hitting far more people than originally intended. Congress enacted the Alternative Minimum Tax (AMT) in 1969 following the discovery that 155 people with adjusted gross income above $200,000 had paid zero federal income tax. The AMT grew so large that it was projected to tax nearly 30 million Americans (20 percent of filers) in 2010.

Additionally, the Spanish American War Tax imposed a 3% federal tax on long distance phone service in 1898. This tax was finally eliminated in 2006, after being imposed on countless Americans. Last, the personal income tax promised to be a tax on the wealthiest Americans. It began in 1913 with a top rate of 7% and hit those with a taxable income of over $500,000. Today, roughly half of American families pay the personal income tax.

While President Joe Biden has not yet endorsed the Warren wealth tax, this tax is clearly a priority for many on the Left. Senator Warren was the only Democrat added to the tax writing Senate Finance Committee this year and she has said this legislation to expand the IRS is one of her top priorities. Even so, President Biden will seek “significant increases in IRS enforcement and auditing,” according to Biden Council of Economic Advisers member Jared Bernstein.

The last time the Democrats were in power, the IRS wrongly used its authority to target and harass taxpayers, especially conservative non-profits.

Most notably, the Obama IRS was caught unfairly denying conservative groups non-profit status ahead of the 2012 election.

Lois Lerner’s political beliefs led to tea party and conservative groups receiving disparate and unfair treatment when applying for non-profit status, according to a detailed report compiled by the Senate Finance Committee.

Because of Lerner’s bias, only one conservative political advocacy organization was granted tax exempt status over a period of more than three years:

“Due to the circuitous process implemented by Lerner, only one conservative political advocacy organization was granted tax-exempt status between February 2009 and May 2012. Lerner’s bias against these applicants unquestionably led to these delays, and is particularly evident when compared to the IRS’s treatment of other applications, discussed immediately below.”

Given that Senator Warren’s wealth tax would double the size of the IRS and could lead to tens of thousands of new IRS agents and auditors, the Lois Lerner scandal could be just the beginning.