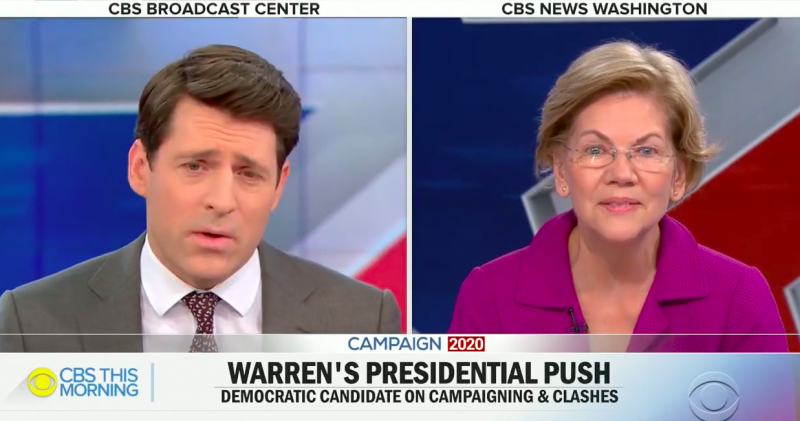

Elizabeth Warren dodged a question about her student loan debt forgiveness plan on Friday morning during a CBS Morning News interview when she was asked what would happen to the middle class families who were responsible and paid their way through college without taking out any student loans.

Here’s the key exchange:

Tony Dokoupil: “Senator, I want to get you on a campaign. I want to get a question to you on a campaign issue. Just last night, there was a video that surfaced. A lot of people are talking about it today. It’s a father who approached you at an event and said, you know, it’s not fair. I’ve saved for my daughter’s college education. And now you’re talking about forgiving and helping out all the people who didn’t save for Americans who were in that father’s position, who felt they did the right thing. And you’re bailing out those who didn’t? What’s your response?’

Warren: “Look, we build a future going forward by making it better. by that same logic, what would we have done not started social security because we didn’t start it last week for you or last month for you? Think of it this way. When I was growing up?, I wanted to be a public school teacher. My family had no money.”

Dokoupil: “Are you saying ‘tough luck’ to these people senator?“

Warren: “So no, what I’m saying is there was a $50 a semester option for me. I was able to go to college and become a public school teacher because America had invested in a $50 a semester.”

Watch below:

This isn’t Warren’s first time misleading the American people or flat out lying to them.

Before Warren released her Medicare for All plan, she dodged the middle class tax question over 20 times and refused to say wheather the middle class would pay more in taxes with her healthcare plan.

In November, Warren released her Medicare for All plan, which she claims to contain no middle class tax increases, which is a lie.

Buried in the footnotes of Warren’s Medicare for all plan is a repeal of the Tax Cuts and Jobs Act — a move that would substantially increase taxes on the middle class.

Warren’s promise to repeal the tax cuts is a promise to raise taxes. If the tax cuts were repealed:

- A family of four earning the median income of $73,000 would see a $2,000 tax increase.

- A single parent (with one child) making $41,000 would see a $1,300 tax increase.

- Millions of low and middle income households would be stuck paying the Obamacare individual mandate tax.

- Utility bills would go up in all 50 states as a direct result of the corporate income tax increase.

- Small employers will face a tax increase due to the repeal of the 20% deduction for small business income.

- The USA would have the highest corporate income tax rate in the developed world.

- Taxes would rise in every state and every congressional district.

- The Death Tax would ensnare more families and businesses.

- The AMT would snap back to hit millions of households.

- Millions of households would see their child tax credit cut in half.

- Millions of households would see their standard deduction cut in half, adding to their tax complexity as they are forced to itemize their deductions and deal with the shoebox full of receipts on top of the refrigerator.

In Warren’s home state of Massachusetts, households making the average income of $77,385 received an average tax cut of around $1,921, according to a recent Tax Foundation report. According to the same report, every congressional district in America received a tax cut.

Still don’t believe us? Take it from left-leaning and establishment media outlets who confirm that the Tax Cuts and Jobs Act helped middle class Americans:

- The New York Times also flatly stated: “Most people got a tax cut.”

- CNN’s Jake Tapper did his own fact check and concluded: “The facts are, most Americans got a tax cut.”

- CNN’s Jake Tapper also stated: “In fact, estimates from both sides of the political spectrum show that the majority of people in the United States of America did receive a tax cut.”

- FactCheck.org stated: “Most people got some kind of tax cut in 2018 as a result of the law.”

- FactCheck.org also stated: “The vast majority (82 percent) of middle-income earners — those with income between about $49,000 and $86,000 — received a tax cut that averaged about $1,050.

- The NYT also stated: “To a large degree, the gap between perception and reality on the tax cuts appears to flow from a sustained — and misleading — effort by liberal opponents of the law to brand it as a broad middle-class tax increase.”

If you want to stay up-to-date on Democrats and their threats to raise taxes, visit www.atr.org/HighTaxDems.