A statue of legendary Vermont Founder Ethan Allen stands proudly at the State Capitol in Montpelier, Vermont.

A statue of legendary Vermont Founder Ethan Allen stands proudly at the State Capitol in Montpelier, Vermont.

With legislators back at the State House in Montpelier to kick off Vermont’s 2024 legislative session, the Democrat/Progressive Party supermajority is searching far and wide for new ways to raise taxes on low- and middle-earners, even as their next door neighbor takes the final step down the path to eliminating its income tax for good.

S.B. 56 would raise income tax rates across each and every bracket, bringing an unpleasant and untimely tax hike to every family, individual, and small business located in the Green Mountain State.

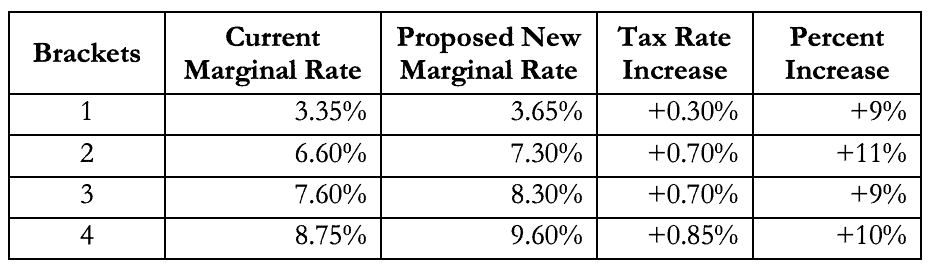

Taxpayers will see a hike of anywhere from 9 to 11%, depending on their level of earnings, as shown in the chart below:

If this $128 million tax hike is enacted, Vermont would move up a spot to become the 6th-highest income tax state in the country.

And, as if that wasn’t bad enough, income taxes would go up again in 2027, taking another $57 million out of Vermonters’ paychecks and ramping up the top rate to 10.05%. As with the first hike, every bracket would take a hit with an average increase of around 5%.

Unlike most states with an income tax, Vermont takes a cut from every dollar earned, allowing for no exemptions. That means these tax hikes will hit every working Vermonter, even those in deep poverty.

All Democrat senators, plus Republican Senator Richard Westman, voted in favor of the bill.

Two days before the Vermont House Committee on Appropriations agreed to take up the income tax increase bill – which they did on the very first day of session – New Hampshire’s interest and dividends tax was slashed in half. Now sitting at just 2%, that tax will disappear for good in less than a year, finally making New Hampshire a true no-income-tax state.

Meanwhile, across the Connecticut River, Vermonters are subjected to a crippling tax regime that touches nearly every aspect of life, shaping what Republican Governor Phil Scott often refers to as an “affordability crisis.”

Property tax rates, for instance, are set by Vermont lawmakers each spring and are projected to go up 18.5% this year, thanks to a 12% jump in education spending. That’s the largest increase in state history, according to Tax Commissioner Craig Bolio.

““For years, I have warned that Vermont is unaffordable for too many families and small businesses. This is why for seven years I focused on holding the line on higher taxes and fees, while offering solutions to reduce the tax burden on Vermonters,” said Governor Scott in a statement. “At a time when housing costs and interest rates are elevated, higher property taxes will make our housing and workforce crises worse, and I sincerely hope the Legislature agrees.”

Unfortunately, the legislature thus far has taken full advantage of their new dominant supermajorities to enact numerous bills that were previously stymied by the governor’s vetoes.

The income tax hike proposed in S.56 comes not long after Democrats and Progressives in both chambers united in support of a 0.44% payroll tax on all Vermonters. In his veto message, Governor Scott offered a withering rebuke of the legislature’s tax-and-spend agenda:

“Supporters of raising taxes and fees will always point to the relatively small amount raised for each individual program or service – trying to suggest it is not that much money. But that type of narrow here-and-there thinking adds up, year after year, and has made living in Vermont increasingly unaffordable. For these reasons, I had to veto this regressive tax plan.”

Nonetheless, the leftist supermajorities immediately overrode Gov. Scott’s veto. That new tax will go into effect on July 1, 2024.

Lawmakers also rammed through a sweeping energy tax bill, again over Gov. Scott’s objections. S.5 establishes a system of carbon credits to subsidize the installation of “clean” heating systems. Fuel dealers would be required to purchase these credits to offset carbon emissions from any traditional heating fuel they sell in the state of Vermont.

With estimates ranging from $2 billion to $5 billion in new, mandatory private spending, that translates to a price hike anywhere from 70 cents to $4.00 per gallon on home heating fuels, which 2/3 of Vermonters depend on to make it through the winter.

Tellingly, the bill sponsor, Senator Christopher Bray – who earned a spot on ATR’s “Naughty” list last month – slyly renamed the bill from “Clean Heat Standard” to “Affordable Heat Act,” after the original bill failed under widespread fear of its expensive price tag.

Sen. Bray and other Vermont lawmakers are just getting started. Unless the legislature changes course, more and more Vermont residents of all socioeconomic statuses will simply pick up shop and drive an hour or two to the east, where residents of neighboring New Hampshire don’t pay a dime in sales taxes or income taxes, and are able to enjoy their lives in what the Cato Institute deems the #1 freest state in the country.