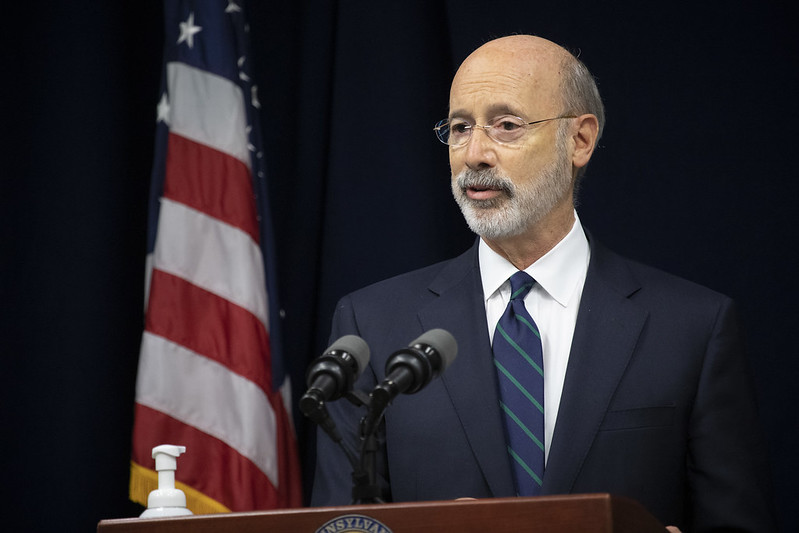

Despite the grueling effects of the pandemic-induced recession, Gov. Tom Wolf of Pennsylvania has proposed the largest tax hike in Pennsylvania history in his executive budget.

The budget proposal includes a massive, job-killing 46% increase in the state income tax.

Gov. Wolf’s proposed income tax hike would dramatically affect working middle-class families, financially at-risk Pennsylvanians, and small businesses. Although he suggested that there would be a “tax forgiveness” program as part of the proposal, families at the median family income (fewer than five children) would still pay more. Even with tax forgiveness, residents will still have to pay $232 each, or $927 per family of four, on average.

This tax hike proposal would be also be detrimental to local, small businesses that already pay the state’s Personal Income Tax. From maintaining an extended, onerous shutdown, to vetoing limited liability protection legislation so businesses could operate without fear of incessant lawsuits, Gov. Wolf has proved himself to be a governor who does not look out for small businesses. Instead, he wants them to pay more taxes as they attempt to recover from the pandemic.

Also included in the budget proposal is a severance tax on the natural gas industry in Pennsylvania, the nation’s second-largest natural gas producer. This would be a double-tax, as Pennsylvania already imposes and impact fee on natural gas extraction.

Gov. Wolf thinks imposing a severance tax would help Pennsylvanians “come out of this pandemic pretty much faster than anything else,” but this is untrue. According to last year’s Pennsylvania Energy Employment Report, natural gas employment in the state declined by 7.4%. A natural gas severance tax would kill more energy jobs and hinder the state from recovering.

Gov. Wolf has advocated for a severance tax in each of his budgets for the last six years and has failed each time; it also remains widely unpopular among the Republican-controlled House and Senate.

Even with these proposed tax hikes, Gov. Wolf is still likely to find ways to overspend and put Pennsylvania deeper into debt. Since he took office in 2015, spending in Pennsylvania has dramatically accelerated and increased by more than $24.5 billion (more than $1,900 per person) and two of the last six budget cycles have yielded tax increases. Despite these tax increases, Gov. Wolf has continued to overspend the approved budget ($400 million in 2016–2017, $673 million in 2018–2019, and more than $1 billion in 2019–2020).

Gov. Wolf signed a late budget without any tax hikes in the final weeks of 2020, but it still contained a 4% spending increase from the year prior and failed to restrict supplemental appropriations. Although Gov. Wolf pushes for tax increases, citing the need for them to provide sufficient revenue for the state, he continues to ask the legislature for supplemental funding. Lawmakers and taxpayers should expect another hefty supplemental request – as it appears that no amount of money will be enough.

According to a report by Pennsylvania’s Independent Fiscal Office, it is projected that it will take about six years for employment to recover from the pandemic-induced recession and strict lockdowns imposed by the Wolf Administration. That’s far too long for families and small businesses in the Keystone State who need immediate economic recovery.

Pennsylvania legislators should reject Governor Wolf’s massive tax hike proposals.