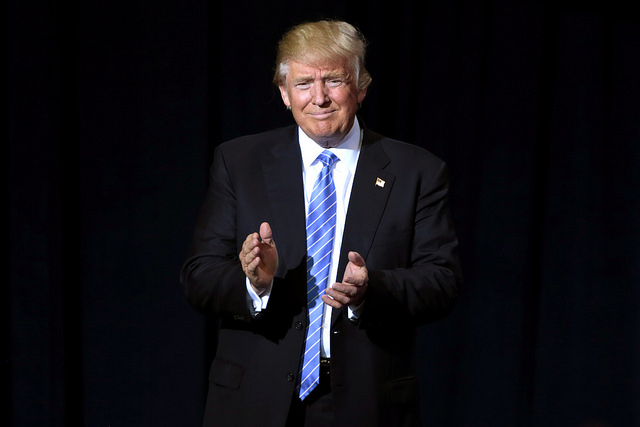

In his first address to a joint session of Congress, President Donald Trump promised “historic” tax reform that will allow American businesses to compete, will reduce rates and complexity for American families, and will grow the economy.

It has been more than 30 years since comprehensive tax reform was last signed into law. Since then, our tax code has almost tripled in size. Today, the status quo of the current tax system is unacceptable and indefensible. Tax reform is desperately needed.

The code is far too complex for American families to understand. The tax code is more than 75,000 pages long and contains over 2.4 million words. This complexity forces American families and businesses to spend more than 8.9 billion hours and $400 billion complying with the code every year.

The US tax code is also the most uncompetitive in the world. The outdated code makes it difficult, if not impossible for businesses to compete with foreign competitors. The federal/state corporate tax rate is almost 40 percent, while small businesses pay rates above 40 percent. By comparison, the average rate in the developed world is just 25 percent. The tax rate has barely changed since 1986 while other countries have cut their rates aggressively. The U.S. is also one of the few countries that still has a worldwide system of taxation, which subjects American businesses to double taxation when they do business overseas.

The tax code is suppressing the economy. Over the next decade, the Congressional Budget Office projects the economy will continue to grow at a stagnant 2 percent, far below the historical average. This insufficiently low economic growth has resulted in too few new jobs and low wages.

President Trump has shown he understands the need for tax reform. In his first year in office, he must continue pushing for desperately needed pro-growth reform.