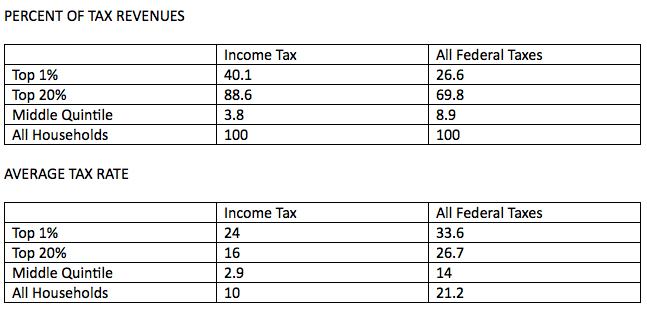

According to the Congressional Budget Office:

-The top one percent of households pay 40.1% of federal income taxes and 26.6% of total federal taxes.

– The top 20 percent of households pay 88.6% of federal income taxes and 69.8% of total federal taxes.

– The top one percent of households pay an average income tax rate of 24% while the middle quintile pays an average income tax rate of 2.9%.

– The top one percent of households pay an average total tax rate of 33.6% while the middle quintile pays an average total tax rate of over 14%.

– The top 20 percent of households pay an average total tax rate of 26.7 percent while the middle quintile pays an average total tax rate of 14%.

The data is shown below: