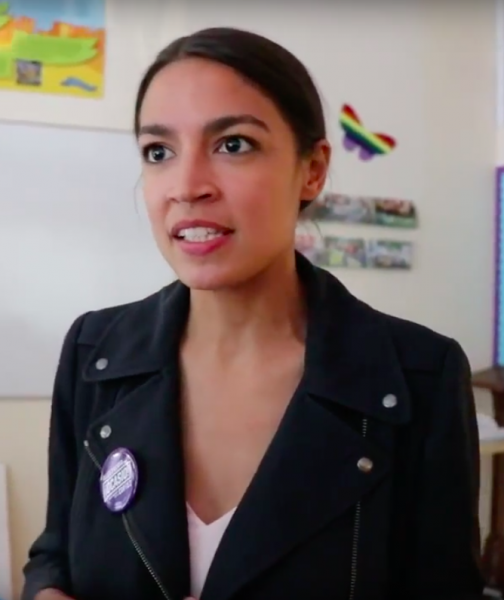

Congresswoman Alexandria Ocasio-Cortez (D-NY) recently proposed a 70 percent top federal income tax rate. This would nearly double the current top tax bracket, which is currently at 37 percent. Ocasio-Cortez fails to mention that the tax code is already steeply progressive.

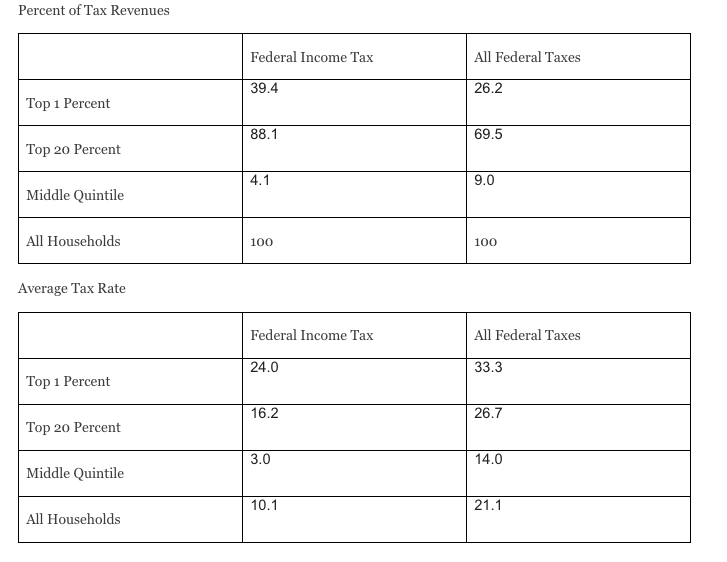

According to the Congressional Budget Office:

-The top one percent of households pay 39.4 percent of federal income taxes and 26.2 percent of total federal taxes.

– The top 20 percent of households pay 88.1 percent of federal income taxes and 69.5 percent of total federal taxes.

– The top one percent of households pay an average income tax rate of 24 percent while the middle quintile pays an average income tax rate of 3 percent.

– The top one percent of households pay an average total tax rate of 33.3 percent while the middle quintile pays an average total tax rate of over 14 percent.

– The top 20 percent of households pay an average total tax rate of 26.7 percent while the middle quintile pays an average total tax rate of 14 percent.

The data is shown below: