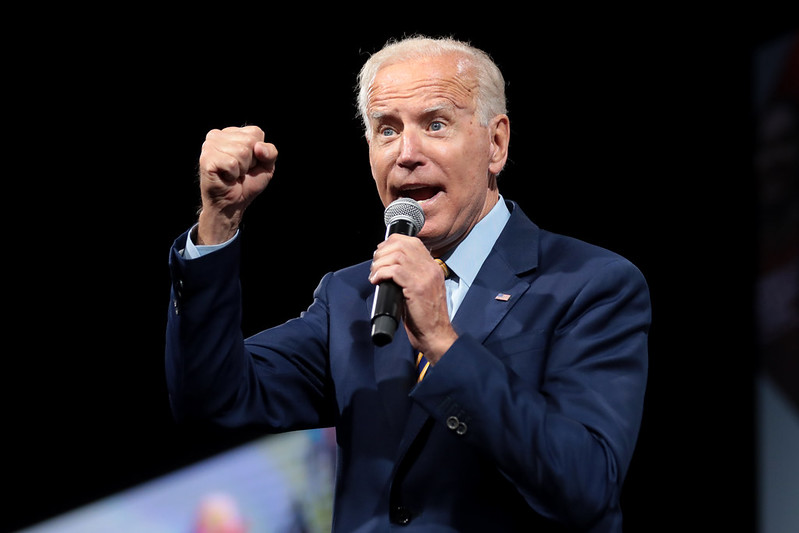

Update: President Biden will today release a $2 trillion tax hike that includes raising the corporate tax to 28 percent, imposing a 15 percent minimum tax on book income, and creating a 21 percent global minimum tax. Biden is expected to announce further tax hikes in the coming weeks including a second death tax, capital gains tax increases, and income tax increases.

President Joe Biden is reportedly proposing almost $2 trillion in higher taxes as part of his “infrastructure” spending plan.

Biden proposes raising the corporate rate from 21 percent to 28 percent and imposing a 21 percent global minimum tax on American businesses. He also calls for doubling the capital gains tax to almost 40 percent, imposing a second death tax by ending step up in basis, and raising the top individual income tax rate to 39.6 percent.

Here are some things you need to know about Biden’s proposed tax increases.

Biden’s tax hikes will hit Main Street small businesses hard. Small businesses that are organized as passthrough entities (sole proprietors, LLCs, S-corps etc.) pay taxes through the individual code and will be hit by Biden’s plan to raise the top income tax rate to 39.6%.

Biden will impose a second Death Tax on households and small businesses. Biden will hit households and small businesses with a second Death Tax: He will eliminate step-up in basis. This will impose a steep tax increase and paperwork nightmare for small businesses, farms, and families.

The Biden corporate tax hike will directly raise your utility bills. If Democrats increase the corporate income tax rate, they will have to explain why they just increased your utility bill. Utility customers bear the cost of taxes imposed on utility companies. Utility companies pay the corporate income tax. Corporate income tax cuts drive utility rates down, corporate income tax hikes drive utility rates up. When Republicans enacted a corporate tax rate cut, utilities across the country lowered their rates.

Biden will impose the highest capital gains tax rate since the 1977 Jimmy Carter “malaise” era. Biden wants to double the capital gains tax rate to 39.6 percent. This is the highest rate since 1977 during the Jimmy Carter era, when the top rate was 39.875 percent.

Inclusive of state taxes and the 3.8 % Obamacare tax, Californians would face a capital gains rate of 56.7%, New Yorkers would face a capital gains rate of 52.2%, New Jerseyans would face a capital gains tax rate of 54.14%.

Raising the corporate tax will harm American workers including those making less than $400,000 per year. As noted in a 2017 study by Stephen Entin of the Tax Foundation, labor (or workers) bear around 70 percent of the burden of corporate taxes. Various economic studies over the last few decades have found that labor bears between 50 percent and 100 percent of the burden of the corporate income tax including a 2006 study by William Randolph of the Congressional Budget Office which found that 74 percent of the corporate tax is borne by domestic labor.

Raising the corporate tax harms Americans with a 401(k), as noted by Len Burman of the Tax Policy Center. In a recent blog, Burman asks and answers the question of whether middle class families would be harmed by the Biden corporate tax hike:

“Does a corporate tax increase or a financial transaction tax raise taxes on shareholders, including the millions of middle-class people who own 401(k) plans? (Answer: yes.)”

53 percent of American households’ own stock, according to the Federal Reserve, while 80 to 100 million Americans have a 401(k) and 46.4 million households have an individual retirement account, according to recent data.

Corporate tax hikes will harm millions of millennials that have begun investing their savings in the stock market. Over 10 million Americans opened brokerage accounts in 2020 and it is estimated that half of Gen-Zers and Millennials are trading in stocks, according to recent reports.

The Biden corporate tax hike will reduce wages and jobs as we recover from the coronavirus pandemic. Prior to the pandemic, the U.S. economy was one of the strongest in modern history. In 2019, median household income increased by $4,440 or 6.8 percent – the largest one-year wage growth in history. Average hourly earnings grew by 3 percent or more for 20 consecutive months between 2018 and the start of 2020, according to BLS. Under this economy, there were more job openings than job seekers for 24 consecutive months. In March 2018, the ratio of unemployed persons to job openings dropped to 0.9.

Biden’s corporate tax hike would make the US rate higher than Communist China’s 25 percent. Inclusive of state taxes which average 4 percent, America’s corporate tax rate would be 32 percent. Not only would this be higher than China it would also be higher than key competitors such as the United Kingdom (19 percent), Canada (26.5 percent), Ireland (12.5 percent), Germany (29.9 percent) and Japan (29.74 percent), according to data compiled by the Organisation for Economic Co-operation and Development (OECD).

A new global minimum tax will make America uncompetitive and see an increase in inversions and foreign acquisitions. During the Obama administration, the uncompetitive tax code was driving companies to consider leaving through an inversion. In 2014 alone, American businesses with combined assets of $319 billion announced plans to invert in 2014, according to the Congressional Budget Office.

The uncompetitive tax code was also causing U.S. businesses to be acquired by foreign businesses. Between 2004 and 2017, the high U.S. rate and worldwide tax system meant non-U.S. companies could outbid U.S. companies. As a result, American companies suffered a net loss of almost $510 billion in assets, according to a study released by EY.

If the corporate rate was lower, the study estimates that U.S. companies would have acquired a net of $1.2 trillion worth of businesses, meaning that more than $1.7 trillion in businesses were lost because of the uncompetitive U.S. rate.