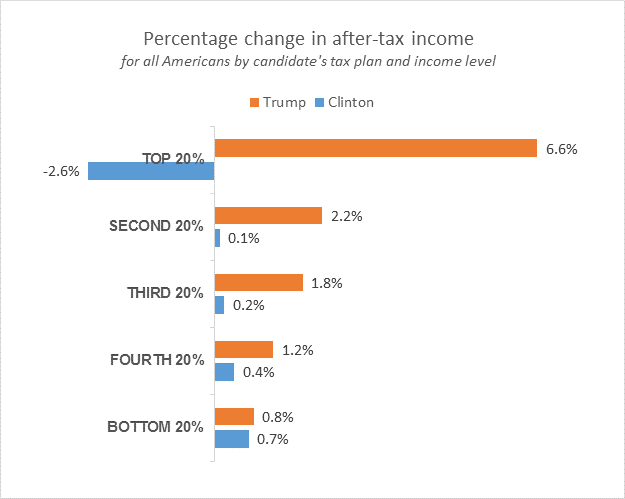

Left of center group’s own numbers show after-tax income under Trump plan is higher than Clinton’s plan for all income levels

Donald Trump’s tax cut plan would increase after-tax income more than the Hillary Clinton’s tax plan regardless of income quintile, according to data published by the left-of-center Tax Policy Center.

As noted in the center-left Tax Policy Center’s data, the middle quintile of income earners would see a 1.8 percent increase in after tax-income under the Trump plan but would receive just 0.2 percent increase in after-tax income under the Clinton plan. The Trump tax cut in this income range is nine times the size of Clinton’s.

Clinton’s tax plan offers no income tax rate reduction for any American of any income level. No rate reduction for any business or any individual, regardless of size.

Data Source: Tax Policy Center

Data Source: Tax Policy Center

Clinton’s overall tax plan raises taxes by $1.4 trillion. Americans for Tax Reform is tracking all of Clinton’s tax hikes at www.HighTaxHillary.com