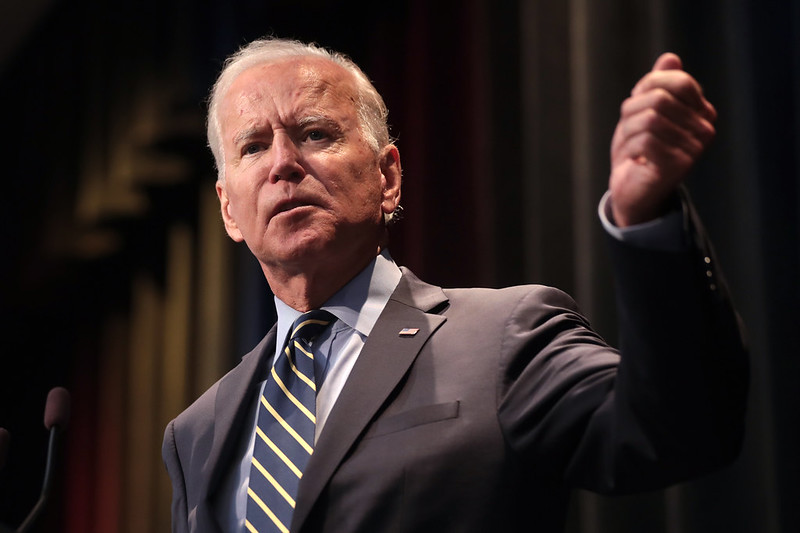

Democrat presidential candidate Joe Biden says he wants to make sure “the rich” pay their “fair share.” However, Biden fails to mention that the tax code is already steeply progressive.

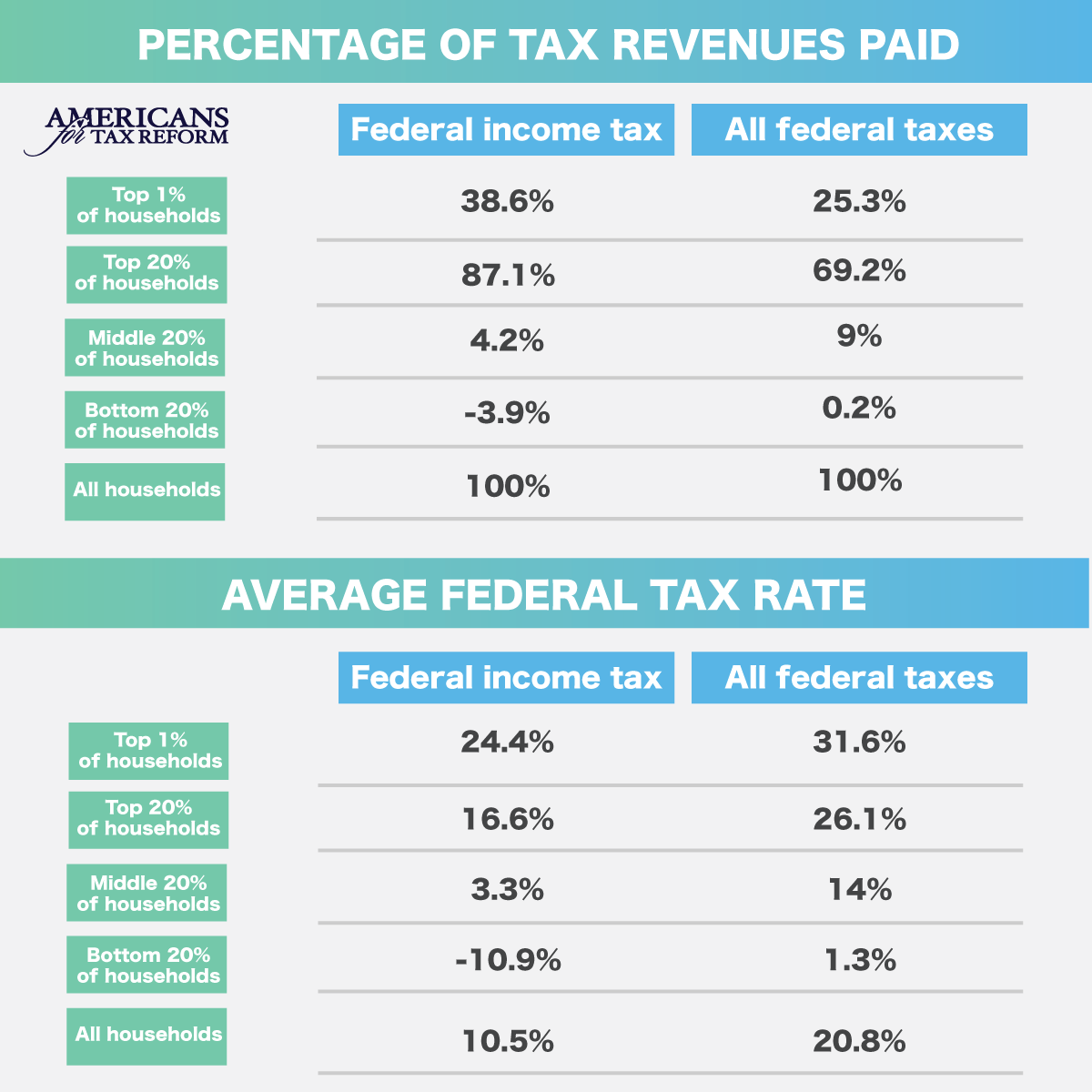

According to recently released Congressional Budget Office data analyzing 2017 household income:

- The top one percent of households pay 38.6 percent of federal income taxes and 25.3 percent of all federal taxes.

- The top 20 percent of households pay 87.1 percent of federal income taxes and 69.2 percent of all federal taxes.

- The top one percent of households pay an average income tax rate of 24.4 percent while the middle 20 percent of households pays an average income tax rate of 3.3 percent.

- The top one percent of households pay an average federal tax rate of 31.6 percent while the middle 20 percent of households pays an average federal tax rate of 14 percent.

- The top 20 percent of households pay an average federal tax rate of 26.1 percent while the middle quintile pays an average total tax rate of 14 percent.

The data is shown below: