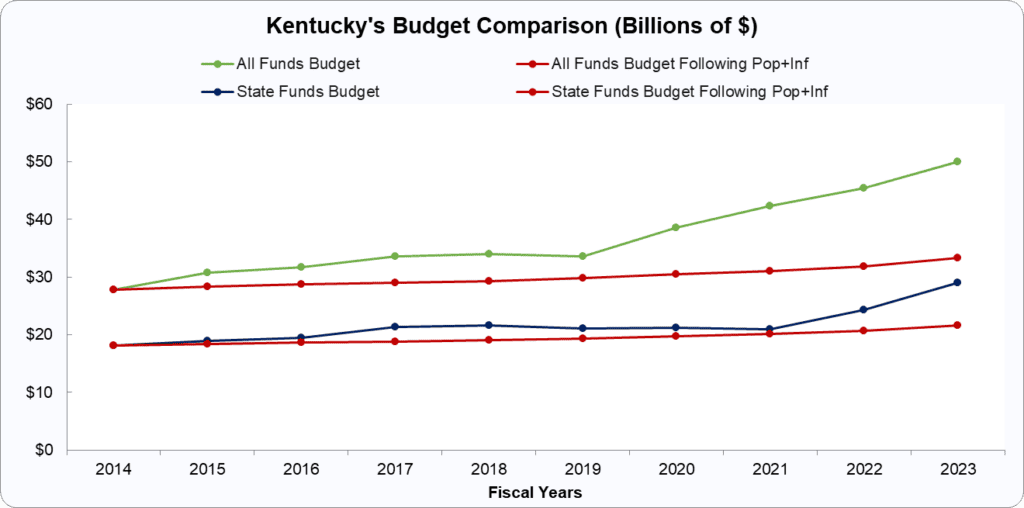

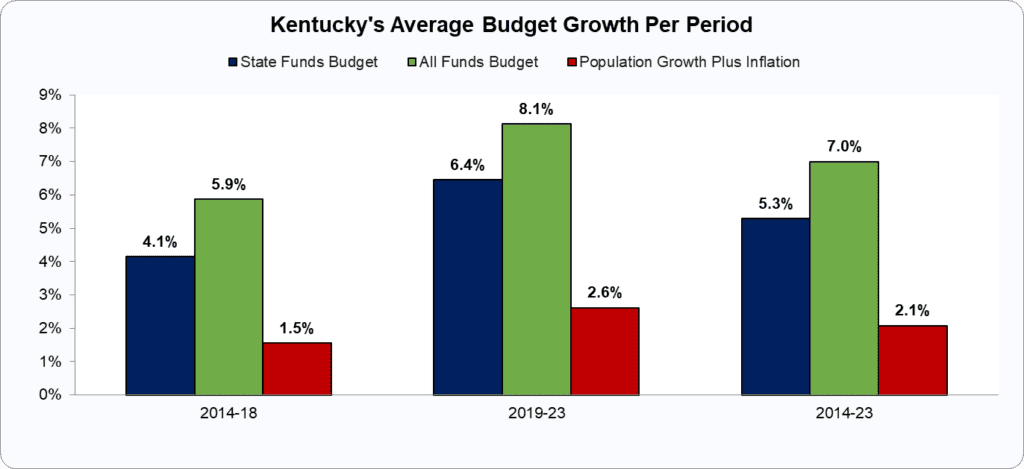

Kentucky’s budget increased cumulatively more than pop+inf in state funds and all funds from 2014-23, meaning taxes are higher than the average taxpayer can afford.

- The 2023 state funds budget is $7.3 billion higher than it would have had spending grown at the rate of population growth plus inflation over the past decade.

- Because the state funds budget grew faster than population growth plus inflation for the last ten years, the state spent and taxed $21.5 billion too much.

- The 2023 all funds budget is $16.7 billion higher than it would have been had spending grown at the rate of population growth plus inflation over the past decade.

- Because the all funds budget grew faster than population growth plus inflation over the past decade, the state spent and taxed $68.2 billion too much.

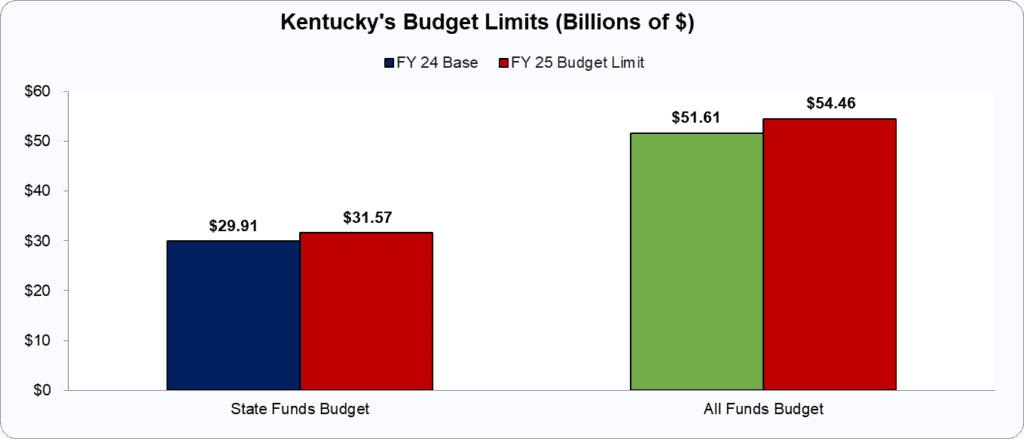

State Funds Budget Data

- Estimated FY 2024 Only State Funds Budget ($ Billions): $29.91

- FY 2025 Only State Funds Budget Limit ($ Billions): $31.56

- FY 2025 Only State Funds Budget Limit Growth ($ Billions): 5.49%

- Cost per person of state funds budgeting more than pop+inf over the last decade in 2023 budget: $1,622

- Cost per family of 4 of budgeting more than pop+inf over the last decade in 2023 budget: $6,488

- Cumulative cost per person of state funds budgeting more than pop+inf over the last decade from 2014-23: $4,752

- Cumulative cost per family of 4 of state funds budgeting more than pop+inf over the last decade from 2014-23: $19,010

State All Funds Budget Data

- Estimated FY 2024 All Funds Budget ($ Billions): $51.61

- FY 2025 All Funds Budget Limit ($ Billions): $54.44

- FY 2025 All Funds Budget Limit Growth ($ Billions): 5.49%

- Cost per person of all funds budgeting more than pop+inf over the last decade in 2023 budget: 3,681

- Cost per family of 4 of all funds budgeting more than pop+inf over the last decade in 2023 budget: 14,726

- Cumulative cost per person of all funds budgeting more than pop+inf over the last decade from 2014-23: 15,069

- Cumulative cost per family of 4 of all funds budgeting more than pop+inf over the last decade from 2014-23: 60,278

Other Considerations

- Economic Freedom of North America (2021) (Rank): 34 [Fraser Institute]

- Economic Freedom (2022) (Rank): 20 [Cato Institute]

- Fiscal Policy (2022) (Rank): 29 [Cato Institute]

- Regulatory Policy (2022) (Rank): 13 [Cato Institute]

- State Tax Collections Per Capita (FY2021) ($): $3,242 [Tax Foundation]

- State Tax Collections Per Capita (FY2021) (Rank): 33 [Tax Foundation]

- State-Local Total Tax Burden per Capita (2022) ($): $4,669 [Tax Foundation]

- State-Local Tax Burden per Capita (2022) (%): 9.60% [Tax Foundation]

- State-Local Tax Burden per Capita (2022) (Rank): 17 [Tax Foundation]

- Top Income Tax Rate (2024) (%): 4.00% [Tax Foundation]

- Top Income Tax Rate (2024) (Rank): 15 [Tax Foundation]

- Flat/Progressive/Zero Income Tax (2024): F [Tax Foundation]

- Overall State Business Tax Climate Index (2024)(Rank): 18 [Tax Foundation]

- Top Corporate Income Tax Rate (2024) (%): 5.00% [Tax Foundation]

- Top Corporate Income Tax Rate (2024) (Rank): 16 [Tax Foundation]

- State-Local Sales Tax Rate (2024) (%): 6.00% [Tax Foundation]

- State-Local Sales Tax Rate (2024) (Rank): 11 [Tax Foundation]

- Property Taxes Paid as a Percentage of Owner-Occupied Housing Value (2021) (%): 0.83% [Tax Foundation]

- Property Taxes Paid as a Percentage of Owner-Occupied Housing Value (2021) (Rank): 31 [Tax Foundation]

- Economic Outlook (2024) (Rank): 28 [American Legislative Exchange Council]

- Economic Performance Rankings, 2012-2022 (2024) (Rank): 24 [American Legislative Exchange Council]

- Tax and Expenditure Limit (0-3): 0 [American Legislative Exchange Council]

- Tax and Expenditure Limit (Rank): 32 [American Legislative Exchange Council]

- Right-to-Work Law (2022) (Y/N): Y [American Legislative Exchange Council]

- State-Local Spending per Capita (2022) ($): $12,237 [US Government Spending]

- State-Local Spending per Capita (2022) (Rank): 22 [US Government Spending]

- Official Poverty Rate (2020-22) (%): 15.8 [Census Bureau]

- Official Poverty Rate (2020-22) (Rank): 45 [Census Bureau]

- Supplemental Poverty Rate (2020-22) (%): 10.8 [Census Bureau]

- Supplemental Poverty Rate (2020-22) (Rank): 43 [Census Bureau]

- Labor Force Participation Rate (Dec 2023) (%): 57.00% [Bureau of Labor Statistics]

- Labor Force Participation Rate (Dec 2023) (Rank): 47 [Bureau of Labor Statistics]