Photo by Ave Calvar on Unsplash

Photo by Ave Calvar on Unsplash

Student loan cancellation will help those who were most financially stable during the pandemic: college graduates. Not only does this reality highlight how unfair this policy is, but it also undermines the Administration’s legal justification for the policy.

In August, Biden announced his plan to cancel $10,000 in student loan debt for borrowers making less than $125,000. Pell Grant recipients who make less than $125,000 would be eligible for $20,000 in cancellation. For couples that file jointly, the limit would be $250,000. The plan also extends the moratorium on student loan repayments until the end of the year.

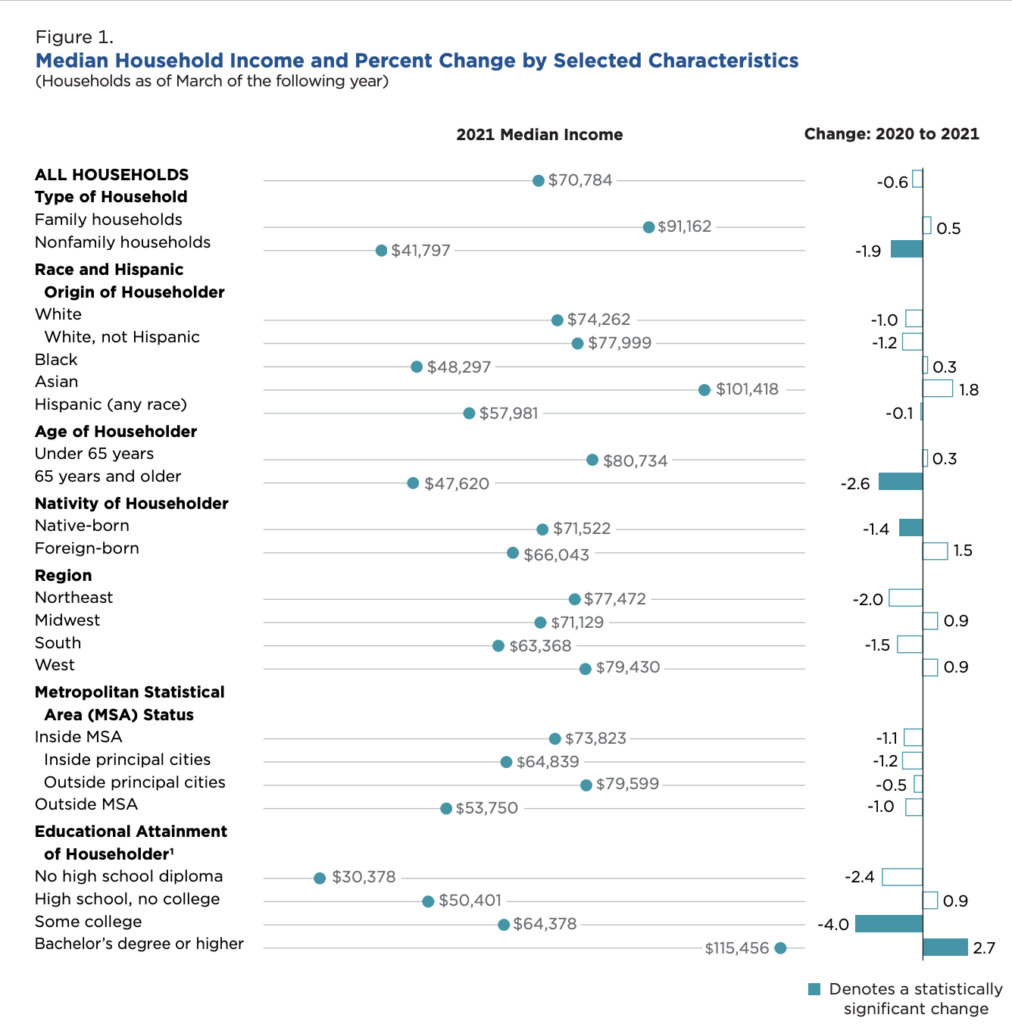

The newly released population report from the U.S. Census Bureau indicates how incomes of different demographic groups changed in the past year. As Michael Hendrix from the Manhattan Institute highlights, Americans with bachelor’s degrees or higher were the only group that saw their real incomes rise in the past year.

From 2020 to 2021, the median income of those with at least a bachelor’s degree rose 2.7 percent. The median income for this group was $115,456, notably still below the administration’s $125,000 threshold for forgiveness:

In the same vein, at peak pandemic unemployment – April 2020 – college graduates had an unemployment rate of 8.4 percent. At the same time, high school graduates suffered a 17.6 percent unemployment rate and those who had not graduated high school suffered a 21.1 percent unemployment rate. By the end of 2021, the unemployment rate for those with college degrees had already dropped to 2.1 percent.

Evidently, college graduates were quite comfortable during the pandemic. Still, the two-thirds of Americans who did not attain a bachelor’s degree – and suffered most during the pandemic – will now be expected to subsidize the cost of this group’s education, which could cost them up to $1 trillion.

College graduates’ good fortune will also undermine the administration’s legal justification for broad loan cancellation.

The administration has justified its actions under the HEROES Act of 2003. This bill gives the Education Secretary the authority to grant student loan relief during a war, military operation, or national emergency. President Biden has cited the pandemic as the national emergency that justifies broad cancellation.

The HEROES Act authorizes the Secretary to waive/modify student loans on behalf of those “who are affected individuals are not placed in a worse position financially in relation to that financial assistance because of their status as affected individuals.”

Ignoring that this bill almost certainly does not grant the President authority to impose sweeping loan cancellation, college graduates cannot be considered “affected individuals” under this bill.

The bill defines an “affected individual” as someone in active duty, in the National Guard, residing in a disaster area, or someone who “suffered direct economic hardship as a direct result of a war or other military operation or national emergency, as determined by the Secretary.”

Considering all evidence points to college graduates doing well during the pandemic, there is certainly no argument to be made that they all suffered direct hardship as a direct result of the pandemic.

Biden’s student loan plan is not about helping the downtrodden. It is, and always has been, a handout to Democrats’ base: wealthy elites in blue states.