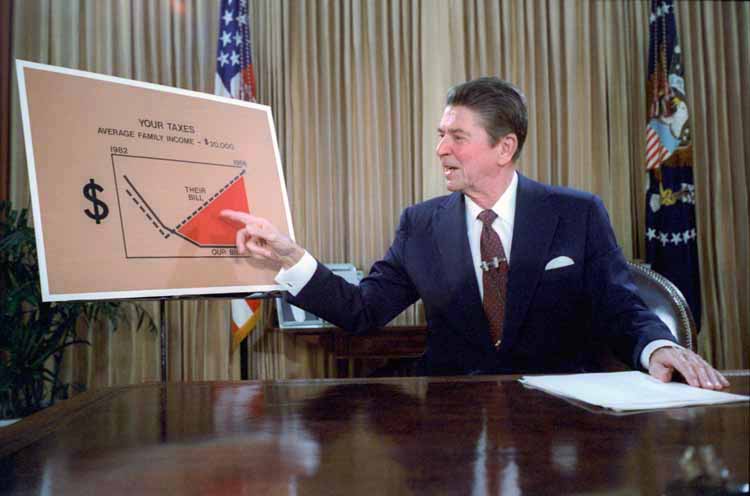

The successful 1986 Tax Reform Act, which reduced income tax rates by eliminating credits and deductions, is a great example of pro-growth tax reform. This simplification of the tax code gets government out of the business of picking winners and losers in the economy.

In recent years, state legislators have introduced proposals to “clean up” their tax codes by eliminating credits and deductions. But be careful; all too often, lawmakers look to eliminate credits and deductions without reducing rates on broad base taxes, which is nothing more than a tax increase. If lawmakers want to get rid of credits and deductions of questionable merit, fine, but that should be done as a way to pay for broad base tax rate reduction, as opposed to funding higher levels of government spending.

State tax codes are littered with billions in tax credits, deductions, exemptions, and exclusions that favor certain industries or activities. Americans for Tax Reform decided to investigate how much states could reduce their income tax by if they eliminated all income tax exemptions.

The information below is from the ten most populous states with an income tax: California, New York, Illinois, Pennsylvania, Ohio, Georgia, North Carolina, Michigan, New Jersey, and Massachusetts. (Note that large states like Texas and Florida do not have a state income tax, and Virginia does not calculate income tax expenditures.)

Between these ten states, there over $86 billion worth of income tax exemptions. If eliminated, these states could reduce their income tax rates across-the-board by between 19 and 43 percent, with four states cutting rates by over one-third.

California: If California eliminated its income tax expenditures – totaling over $40 billion – they could reduce their rates by 34 percent. Their updated tax code would look like this:

New York: If New York eliminated its income tax expenditures – totaling $11.5 billion – they could reduce their rates by 20 percent. Their updated tax code would look like this:

Illinois: If Illinois eliminated its income tax expenditures – totaling $4.35 billion – they could reduce their single rate by 20 percent. Their updated tax code would look like this:

Pennsylvania: If Pennsylvania eliminated its income tax expenditures – totaling $9 billion –they could reduce their single rate by 43 percent. Their updated tax code would look like this:

Ohio: If Ohio eliminated its income tax expenditures – totaling $2.1 billion – they could reduce their rates by 19 percent. Their updated tax code would look like this:

Georgia: If Georgia eliminated its income tax expenditures – totaling $2.65 billion – they could reduce their rates by 21 percent. Their updated tax code would look like this:

North Carolina: If North Carolina eliminated its income tax expenditures – totaling $2.7 billion – they could reduce their single rate by 19 percent. Their updated tax code would look like this:

Michigan: If Michigan eliminated its income tax expenditures – totaling $5.5 billion – they could reduce their single rate by 39 percent. Their updated tax code would look like this:

New Jersey: If New Jersey eliminated its income tax expenditures – totaling $7.8 billion – they could reduce their rates by 36 percent. Their updated tax code would look like this:

Massachusetts: If Massachusetts eliminated its income tax expenditures – totaling $2.7 billion – they could reduce their single rate by 32 percent. Their updated tax code would look like this: