Democrats are pushing another costly entitlement that would impose onerous mandates on employers and increase taxes on American workers and businesses. This time, the left is using the issue of paid family leave as an excuse to push this dramatic expansion of government.

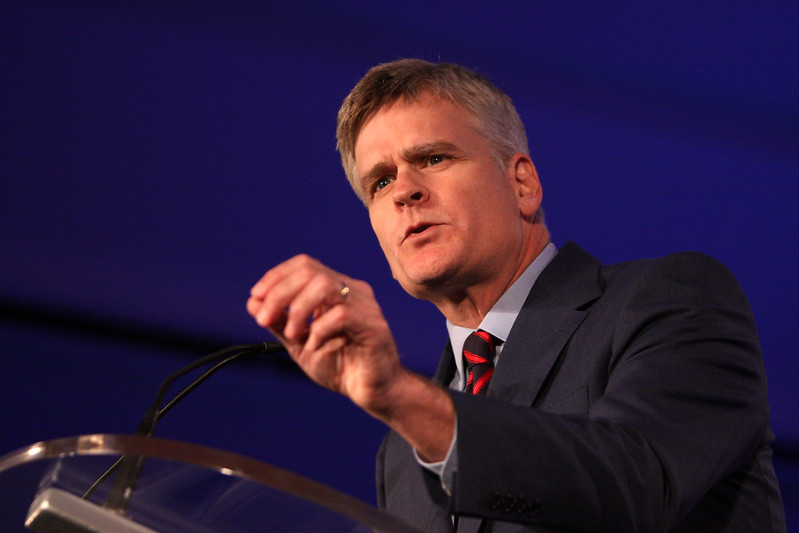

There are alternative proposals for improving paid family leave, such as Senators Bill Cassidy (R-LA) and Kyrsten Sinema’s (D-AZ) plan, which can achieve this goal without raising taxes or creating new entitlements.

The Democrat plan, the Family and Medical Insurance Leave (FAMILY) Act, introduced by Senator Kirsten Gillibrand (D-NY) and Congressman Rosa L. DeLauro (D-CT), would increase payroll taxes to create an Office of Paid Family and Medical Leave within the Social Security Administration.

The Gillibrand-DeLauro plan would disproportionately harm American workers and would cost $547 billion over 10 years, according to the Congressional Budget Office’s estimates. The tax would equal 0.4 percent of a worker’s wage, split in half between employer and employee.

Despite burdening low-income Americans with yet another left-wing tax hike, the 0.4 percent payroll tax that Gillibrand and DeLauro claim will fund their entire proposal would only raise $319 billion over 10 years, $228 billion short of the programs’ $547 billion cost, according to the CBO. The government would need to impose a 0.9 percent payroll tax just to cover the same number of Americans that currently utilize FMLA.

In reality, the program could require further tax increases as noted by an American Action Forum study. According to this study, more people would utilize the FAMILY Act than currently access FMLA. This would require an additional 2.6 to 2.9 percent payroll tax, on top of the current 15.3 percent payroll tax that funds Medicare and Social Security.

In contrast to this massive tax hike, the Cassidy-Sinema family leave plan creates an option with no tax increases or mandates. This plan, which President Trump endorsed in his State of the Union address, allows American families to take a $5,000 advance on their Child Tax Credit.

TCJA doubled the CTC to $2,000, but to offset the advancement, parents who opt in for the Cassidy-Sinema plan would accept a reduced CTC of $1,500 for the next ten years. Parents whose employers or state already provide paid leave or similar programs would still be able to utilize existing programs, on top of the CTC advance.

While Democrats push a costly new plan that will raise taxes on low-income workers and place new mandates on businesses, the Cassidy-Sinema plan delivers the best possible relief to families without creating new bureaucracy or adverse effects down the line.