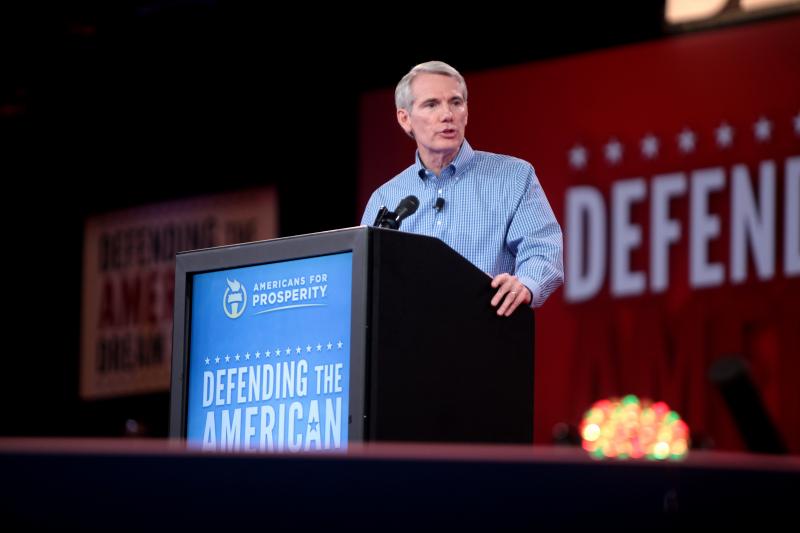

Senator Rob Portman (R-Ohio) has released a bipartisan retirement reform bill alongside Senator Ben Cardin (D-Md). The ‘Retirement Security and Savings Act of 2019’ enacts sweeping, common sense reforms in order to advance the American retirement system into the 21st century.

The legislation includes numerous reforms that strengthen 401(k) plans. These popular and important to American families because they allow individuals control over their own retirement savings. Contributions to 401(k)s are tax free and any gains accrued are also tax free. Additionally, most employers offer some sort of ‘matching contribution’ plan wherein the company will match, up to a point, whatever contributions a worker makes to their own 401 (k) account. This not only boosts savings, it also allows workers to more directly manage their own retirement plans.

Portman’s bill contains provisions dedicated to solving one of four goals — offering relief to Americans who have saved too little for retirement, incentivizing and supporting small business retirement plans, promoting accessibility to retirement savings for low-income workers, and offering flexibility for current or near retirees.

Help for Workers who have Saved too Little:

Unfortunately, many Americans approach retirement age with insufficient savings. This bill contains a number of provisions that remove regulations that hamper late-term saving and make it easier for workers to contribute to retirement accounts later on in their careers.

The first of these provisions is an employer tax credit which is made available by automatically enrolling workers in ‘safe harbor’ plans at a rate of 6% of pay (on top of the current 3% of pay safe harbor). The bill also increases the ‘catch up’ contribution cap from $6,000 to $10,000 for people 60 years or older. Additionally, the plan allows employers to make matching contributions to retirement plans equal to the amount workers are paying towards their student loan debt.

Small Business Retirement Plan Incentives:

Small businesses are burdened by complex and overbearing IRS regulations which impact retirement plans for their workers. Portman’s bill simplifies these rules and makes it easier for small business employees to save for retirement.

The proposal increases the tax credit for new small business retirement plans form $500 to as much as $5,000. It also provides a tax credit for small businesses which offer more generous ‘safe harbor’ plans to their workers. On top of this, the bill also eliminates penalties for unintentionally violating complex IRS retirement plan rules as long as the company self corrects its mistakes.

Retirement Access for Low-Income Workers:

Low-income Americans often live paycheck to paycheck, making it difficult to save for retirement. This bill expands access to retirement for these workers by cutting taxes and simplifying retirement plans.

The plan lowers the income threshold for ‘Saver’s Credit’, expanding access to those who need it most. Additionally, Portman makes ‘Saver’s Credit’ directly refundable into retirement accounts with a new ‘government match’. The bill also expands 401 (k) eligibility to part-time workers who put in 500 – 1,000 hours for two years in a row.

Flexibility for Current Retirees:

Increased life expectancy along with the changing nature of work make it more desirable for many Americans to continue working later and contributing to their retirement accounts. Current regulations punish them for doing this. Portman’s bill allows workers to more fully control their own retirement.

It does this by first, gradually increasing the age for required minimum distributions to 72 by 2023 and 75 by 2030. It also exempts people with $100k or less in retirement savings from the required minimum distributions, allowing them to continue contributing to their retirement savings. Finally, the bill encourages the expansion of ‘QLAC’s’ – retirement plans which pay out annually to retirees who live past their life expectancy.

The Retirement Security and Savings Act of 2019 makes great, long-needed reforms to the American retirement system. It makes saving much easier for low-income workers, and it incentivizes the creation of new retirement plans for small businesses. Ultimately, this is a bipartisan, common sense bill which provides more financial control to workers and small businesses. Several members of the Senate Finance Committee have expressed support for the bill, but the rest of Congress needs to come around and support these reforms to serve the American people.