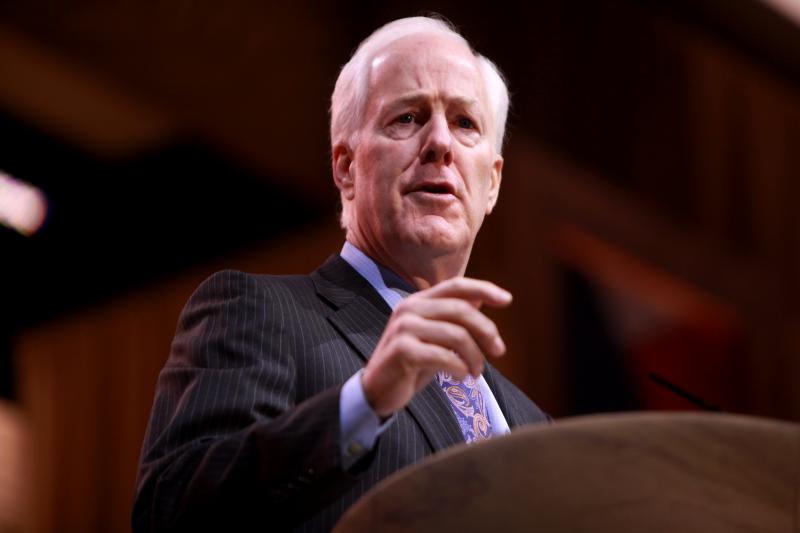

Senator John Cornyn (R-Texas) last month introduced The Small Business Taxpayer Bill of Rights Act of 2021, legislation that would enact several important reforms to the Internal Revenue Service (IRS) so that small businesses and individuals are better protected from efforts by the agency to abuse its power.

Strengthening taxpayer protections is especially important now, as President Joe Biden has introduced his plan to increase IRS funding by $80 billion, leading to 87,000 additional IRS agents, more audits, and intensified enforcement. Biden’s plan would also include provisions giving the IRS heightened power to access taxpayers’ private information, including mandating banks and third-party payment providers (like Venmo and PayPal) to report money going in and out of taxpayers’ accounts to the agency.

ATR urges lawmakers to support and co-sponsor The Small Business Taxpayer Bill of Rights Act of 2021.

Strengthens Taxpayer and Small Business Protections

Senator Cornyn’s bill contains numerous provisions to ensure the IRS is acting in the best interests of taxpayers.

First, this bill would ban any secret conversations between IRS employees and the IRS Independent Office of Appeals when discussing a taxpayer’s case. Violating this prohibition would be a fileable offense, in order to ensure the independence of the IRS Office of Appeals, which was created to protect taxpayers.

In the same vein, the bill prohibits the IRS Independent Office of Appeals from raising new issues or theories during a conference with taxpayers and the IRS.

Under this law, the IRS would need taxpayers’ consent before allowing IRS Counsel or compliance officials to participate in Appeals conferences, eliminating IRS policy that otherwise makes Appeals a more contentious proceeding.

The bill would also add more protection against unnecessary lien foreclosures on a taxpayer’s home and increases the penalties for IRS agents who violate taxpayer rights by committing extortion, fraud, or bribery.

Protects Taxpayers from IRS Improper Targeting

The bill also contains reforms to protect taxpayers from being targeted by the IRS. For instance, Sen. Cornyn’s legislation makes it a fireable offense to apply disproportionate scrutiny to any applicant applying for tax-exempt status based on any ideology expressed in the name or purpose of the organization.

The legislation also requires the Inspector General to review and consult with the IRS on any criteria it uses to select tax returns for audit, assessment, or any heightened scrutiny or review, to ensure that the criteria does not discriminate against taxpayers on the basis of race, religion, or political ideology.

These provisions are especially important, given the IRS has a history of improperly targeting taxpayers. Most notably, the Obama IRS was caught unfairly denying conservative groups non-profit status ahead of the 2012 election.

Lois Lerner’s political beliefs led to tea party and conservative groups receiving disparate and unfair treatment when applying for non-profit status, according to a detailed report compiled by the Senate Finance Committee.

Because of Lerner’s bias, only ONE conservative organization was granted tax exempt status over a period of more than three years:

“Due to the circuitous process implemented by Lerner, only one conservative political advocacy organization was granted tax-exempt status between February 2009 and May 2012. Lerner’s bias against these applicants unquestionably led to these delays, and is particularly evident when compared to the IRS’s treatment of other applications, discussed immediately below.”

At the time, the Obama administration assured the American people that justice would be served. Nonetheless, not a single person was punished for this outrageous targeting.

Since this scandal, the IRS has done little to prevent similar abuses. A 2016 report by the Government Accountability Office warned that the IRS may still be unfairly targeting non-profits “based on an organization’s religious, educational, political, or other views.”

Compensates Taxpayers for IRS Abuses

Sen. Cornyn’s legislation also ensures taxpayers are protected from crushing litigation fees. For instance, instead of small business owners being forced to choose between paying the IRS for a frivolous claim or paying a lawyer to defend them, this bill would allow owners to petition for attorney’s fees when a court determines the IRS’s legal actions are not substantially justified.

If the IRS recklessly or intentionally disregards the law, its own regulations, or illegally releases tax information, the bill increases the amount of civil damages a taxpayer can be rewarded and provides more time that small businesses can be awarded.

The legislation also compensates individuals for “No Change” National Research Program (NPP) Super-Audits, which are audits that occur randomly and require every single line item of return and proof of each item in detail. The bill would allow a deduction for those who undergo the super-audit, particularly because they must represent themselves.

Lowers Compliance Burden for Taxpayers

To allow for a speedier and less costly resolution of audits, the bill creates new alternative dispute resolution procedures to be conducted by an independent, neutral party not employed by the IRS.

Finally, the bill grants small businesses the opportunity to become compliant without going out of business or firing workers when faced with paying a harsh levy.

Under Biden’s plan, legions of new IRS agents will be unleashed for invasive and time-consuming audits of middle-class Americans and small businesses. Even though the IRS hasn’t yet corrected ideological discrimination or blatant incompetence within the agency, the administration still plans to flood the agency with $80 billion and extensive new powers. With this in mind, safeguards against IRS abuses are absolutely necessary.

Senator Cornyn’s Small Business Taxpayer Bill of Rights Act contains numerous important reforms to protect taxpayers against an out of control IRS. If lawmakers are serious about protecting taxpayers from IRS harassment and abuse of power, they should support and co-sponsor this commonsense legislation.