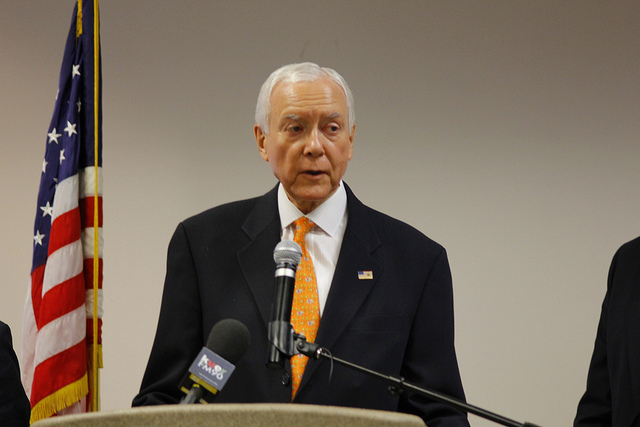

The Senate Finance Committee today considered legislation to improve 529 college savings plans. ATR applauds the work of Chairman Orrin Hatch (R-Utah) and Senator Chuck Grassley (R-Iowa) to improve this important savings plan and help middle class families invest in their children’s college education. Earlier this year, President Obama attempted to hike taxes on this commonly used plan, but was forced to drop the proposal after backlash from middle class families.

529 savings plans help middle class families invest in their children’s futures. These plans allow parents to invest after-tax earnings into a plan that collects interest, and can later be spent tax-free on their children’s college education. As of 2014, an average of $21,000 has been invested in nearly 12 million accounts.

The common-sense legislation approved by the Senate Finance Committee updates 529 plans to include new technology such as computers and reduces the complexity of setting up and using a 529 plan. The House of Representatives already passed similar legislation by a 401-20 margin in February.

However, as ATR has previously reported, President Obama’s 2015 Budget proposed taxing 529 savings plans despite his prior public support for 529 plans. After public backlash from middle class families, the President reluctantly backtracked on this proposal and removed it from his budget proposal.

Below is the timeline of President Obama’s hypocrisy on 529 savings plans.

- August 3, 2006: As U.S. Senator, votes to make 529s permanent.

- 2006: Praises 529s in his book, The Audacity of Hope.

- 2007: Makes a $240,000 contribution to his own 529 accounts.

- Sept. 9, 2009: White House Task Force on Middle Class Working Families issues a detailed report on 529s. Top conclusion from the report:

“529 plans are an attractive and convenient means of saving for college.”

The report makes several recommendations on how to further promote 529s.

- Sept. 9, 2009: Vice President Biden, Treasury Secretary Geithner, and Education Secretary Arne Duncan share a stage at a Middle Class Task Force event at Syracuse University. Geithner strongly touts 529 plans:

“As the Vice President has said, we are also working to implement, expand or improve a wide array of other government programs that encourage education savings and increase college enrollment. Today I want to highlight one program in particular, Section 529 savings plans.

These plans can be an immensely effective way for Americans to save for college. They are generally administered by the states, and they allow people to put aside money for college and enjoy investment earnings that are free of federal taxes and, in some cases, receive state tax benefits, as well. When state tax benefits are included, a typical middle class family can accumulate 25 percent more in 529 accounts than they can in a typical taxable savings account.”

- Sept. 9, 2009: Official White House statement praises 529s:

“A 529 plan, offered by states, provides a convenient, tax-preferred way for families to save for college, and works much like ROTH IRAs, wherein contributions are made with after-tax income, returns accumulate tax free and distributions can be for qualified educational expenses without taxes.”

- July 23, 2010: President Obama sits for a lengthy interview on ABC’s Good Morning America. He was asked, “can you feel the pain directly that other Americans are feeling?” Obama answers by citing his 529s as an example of how he can identify with the middle class:

“Well, part of it has, that part that is devoted to Malia and Sasha’s college fund was in a 529, you know, that had been set up when I was still a state senator. And, obviously, that goes up and down with the stock market and so it’s lost value like everybody else.”

- Jan. 17, 2015: On a Saturday evening, the White House shares with reporters an outline of President Obama’s tax plan. The ten-page, single-spaced document describes 529s as “upside-down.”

- Jan. 23, 2015: White House Council of Economic Advisers chairman Jason Furman, in an interview with BloombergBusinessweek, deems 529s “ineffective” and “tilted towards the upper end.”

- Jan. 23, 2015: White House spokesman Josh Earnest dismisses a reporter question on 529s:

“My guess is those who are saying that are critics of the president. And that’s fine. The—I think the facts about the president’s proposal speak for themselves.”

- Jan. 27, 2015: Anonymous Obama administration official announces that the White House is abandoning its plans to tax 529s.