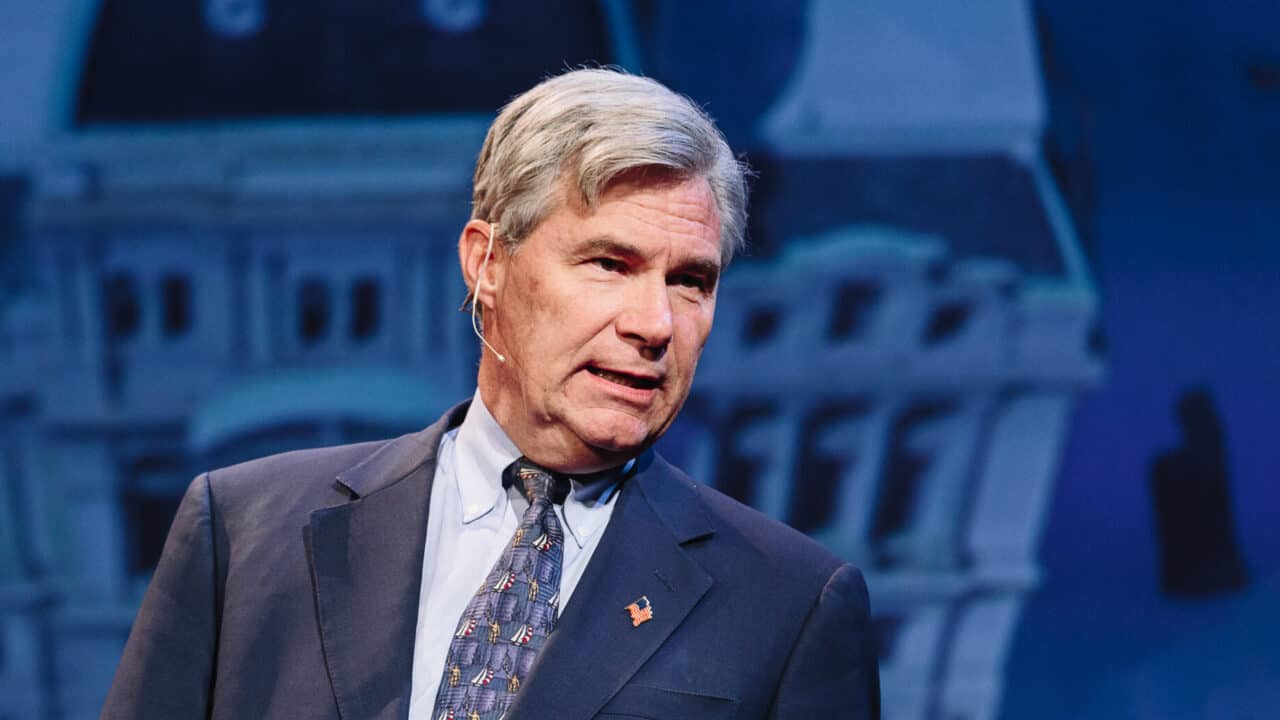

"Senator Sheldon Whitehouse. TEDx Providence 2017" by TEDx Providence is licensed under CC BY-NC-ND 2.0. https://flic.kr/p/YMNmYd

"Senator Sheldon Whitehouse. TEDx Providence 2017" by TEDx Providence is licensed under CC BY-NC-ND 2.0. https://flic.kr/p/YMNmYd

Democrats on the Senate Finance Committee’s Subcommittee on Taxation and IRS Oversight held a hearing entitled “Laws and Enforcement Governing the Political Activities of Tax Exempt Entities.” In this hearing, Senate Democrats advocated for policies that would chill political speech, undermine donor privacy rights, and empower the IRS.

During the hearing, Subcommittee Ranking Member John Thune (R-S.D.) outlined the importance of protecting private giving:

“Free speech is not just good in theory. It is a key driver of a healthy democracy. And allowing Americans to privately give to causes they care about is a fundamental component of protecting free speech and the First Amendment. Partisan legislation to force tax exempt groups to choose between spreading their message and protecting donors’ privacy runs a real and, potentially corrosive, risk of chilling speech.”

Unfortunately, Senate Democrats on the subcommittee championed several of the partisan policies Sen. Thune criticized.

Senator Debbie Stabenow (D-Mich.) insisted that Congress should pass the DISCLOSE Act which would chill political speech by modifying the “stand by your ad” disclaimer in video advertisements to force organizations to identify their top five donors at the end of advertisements. This represents a radical change in policy: currently, the “stand by your ad” provision simply requires a statement by the candidate or organization/corporation that they approve the communication.

In addition, the bill mandates the disclosure of all the names and addresses of donors giving more than $10,000 to groups that engage in “campaign-related disbursements.” With the incredible rise in partisanship, cancel culture, and doxing, it is more important than ever to protect donor privacy.

Senate Democrats also argued that the IRS should impose, once again, its Schedule B form requirement on 501(c)(3), 501(c)(4), and 501(c)(6) organizations. A Schedule B form would require these organizations to submit personal information, like names and addresses, of their donors to the IRS.

In 2020, the Trump Administration finalized a rule that no longer required tax-exempt organizations to submit the form to the IRS. Schedule B forms were not and would not be used for any official purpose. Instead, they created needless compliance costs on both non-profits and the IRS. Importantly, this was never public information, so the assertion that this requirement would expose dark money to the public is simply wrong.

Despite these forms not being public, their existence is still a tool of the left to chill political speech. Under the Obama administration, there were several cases where agency officials leaked the sensitive information contained on Schedule B forms for political purposes, such as leaking of the schedule B belonging to the National Organization for Marriage.

Since then, the IRS has done no due diligence in preventing leaks. Last year, it was revealed that the private tax files of “thousands” of Americans – covering a period of 15 years — had been stolen and given to ProPublica, who then posted this private information. The IRS and the Biden administration immediately vowed to investigate and prosecute. Yet here we are 11 months later, still with no answers from the government. Certainly, the IRS cannot be trusted to be good stewards of even more sensitive information.

Throughout the hearing, several Senators and witnesses also claimed that, to solve the problem of “dark money,” the IRS needed significantly more funding.

This is yet another excuse the Democrats are using to push for the supersizing of the IRS.

In their Build Back Better plan, Democrats included $80 billion in additional IRS funding. Out of nearly $80 billion in new IRS funding, $44.9 billion, more than half, would have gone directly towards enforcement. Additional IRS funding would lead to the targeting of middle-class taxpayers and small businesses and would fund an already incompetent and corrupt agency.

If given new powers to go after tax-exempt organizations, the IRS could use this as a way to target organizations based on their political or religious beliefs.

This is not hypothetical. The last time the Democrats were in power, the IRS wrongly used its authority to target and harass taxpayers, especially conservative non-profits. Most notably, the Obama IRS was caught unfairly denying conservative groups non-profit status ahead of the 2012 election. Lois Lerner’s political beliefs led to tea party and conservative groups receiving disparate and unfair treatment when applying for non-profit status. Because of Lerner’s bias, only one conservative organization was granted tax exempt status over a period of more than three years.

In this hearing, Senator Sheldon Whitehouse (D-R.I.) described this as a “fake scandal” and claimed there was no political bias involved. However, the result of a two-year, bipartisan investigation into this matter by the Senate Finance Committee led to a detailed report confirming the discriminatory acts.

The ability to support causes privately is a vital right, especially at a time when your beliefs can get you doxxed, canceled, or even put in harm’s way. Lawmakers should focus on strengthening privacy rights and ensuring the IRS is not given any new tools to discriminate against Americans.