Rep. Suozzi Threatens to Oppose $3.5 Trillion Package if SALT Deduction Cap is not Repealed

As Democrats claim the wealthy do not pay enough taxes, they continue to fight for a six-figure tax break for wealthy Americans in blue states: removing the cap on the State and Local Tax (SALT) deduction.

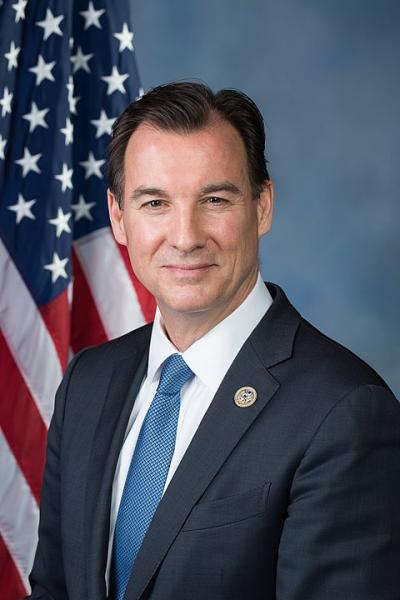

Yesterday, Congressman Tom Suozzi (D-N.Y.) announced that he still stands by his commitment to oppose any changes in the tax code unless the SALT deduction cap is removed.

Blue State Democrats have repeatedly pushed for this tax cut:

- 11 Democrats on the tax-writing Ways and Means Committee wrote a letter to the White House urging that the next major legislative package includes a repeal of the SALT deduction cap. These members included Reps. Bill Pascrell (D-N.J.), Tom Suozzi (D-N.Y.), Mike Thompson (D-Calif.), John B. Larson (D-Conn.), Danny K. Davis (D-Ill.), Earl Blumenauer (D-Ore.), Brian Higgins (D-N.Y.), Judy Chu (D-Calif.), Bradley S. Schneider (D-Ill.), Jimmy Panetta (D-Calif.), and Jimmy Gomez (D-Calif.).

- Rep. Suozzi led three other members, Reps. Bill Pascrell (D-N.J.), Mikie Sherrill (D-N.J.), and Josh Gottheimer (D-N.J.), to make the “No SALT, No Deal” pledge.

- Nearly the entire New York congressional Democrat delegation said they’d “stand ready to oppose any tax legislation that does not fully restore the SALT deduction,” apart from Reps. Alexandria Ocasio-Cortez (D-N.Y.) and Kathleen Rice (D-N.Y.).

- Senate Democrats reaffirmed their support for tax breaks for the wealthiest Americans in blue states when they all voted against Sen. Chuck Grassley’s (R-Iowa) recent amendment to prevent the lifting of the SALT deduction cap in the $3.5 trillion reconciliation bill.

In 2017, the Republican Tax Cuts and Jobs Act (TCJA) capped the SALT deduction at $10,000 in order to pay for much needed tax relief for working- and middle-class Americans. Democrats from high-tax blue states are desperate to repeal the SALT cap because their constituents balk at the true tax burden from living in these states. Repealing the SALT deduction cap would shield taxpayers from bad state tax policy.

Many Democrats blatantly lie when claiming that the SALT deduction cap harms the middle class. Rep. Suozzi claimed in his announcement that, “The cap on the SALT deduction has been a body blow to the state and middle-class families of New York.” This is not true.

In reality, a majority of Americans do not claim the SALT deduction, or any deduction for that matter. Instead, they claim the standard deduction. In 2018, 133 million American taxpayers (or 87% of filers) claimed the standard deduction. These taxpayers deduct zero state and local taxes. In addition, most middle-income taxpayers in blue state saw a significant tax cut. According to IRS Statistics of Income Data, the average taxpayer in both New York State and New Jersey earning between $50,000 and $200,000 saw a tax cut between 2017 and 2018.

Many on the left have already acknowledged that the SALT cap does little or nothing to benefit the middle class. For instance:

- The New York Times described the SALT deduction as “The Tax Cut for the Rich That Democrats Love.”

- The Center for American Progress has stated that repeal of the SALT cap “should not be a top priority” as it would “overwhelmingly benefit the wealthy, not the middle class.”

- Referring to repealing the SALT deduction, Rep. Alexandria Ocasio-Cortez said, “I think it’s just a giveaway to the rich… and I think it’s a gift to billionaires.”

- Senator Bernie Sanders (I-Vt.) recently criticized efforts to repeal the SALT cap, arguing that it “sends a terrible, terrible message… You can’t be on the side of the wealthy and the powerful if you’re gonna really fight for working families.”

- The left-of-center Tax Policy Center found that the top 1 percent of households would receive 56 percent of the benefit of repealing the SALT cap, and the top 5 percent of households would receive over 80 percent of the benefit. The bottom 80 percent of households would receive just 4 percent.

- The Brookings Institution explained that almost all (96 percent) of the benefits of SALT cap repeal would go to the top quintile, 57 percent would benefit the top one percent (a cut of $33,100), and 25 percent would benefit the top 0.1 percent (for an average tax cut of nearly $145,000). Whether or not this is a tax cut for the wealthy is not up for debate—the evidence is clear.

Restoring the full SALT deduction would cost $88.7 billion in lost revenue for 2021 alone, or $400 billion in total, as the cap sunsets in 2026 along with several other tax provisions.

This initiative is especially egregious because, in order to “pay for” this package, Democrats plan to raise the corporate tax, double the capital gains tax, and create a Second Death tax – all policies which would disproportionately hurt workers, consumers, retirees, and small businesses. Increasing taxes on these groups in order to pay for a tax cut for the wealthy is both hypocritical and an awful policy.