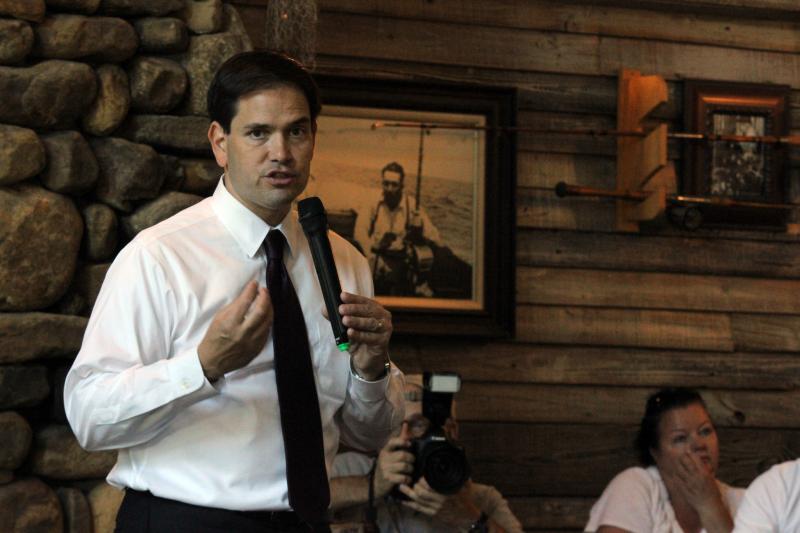

Senator Marco Rubio (R-Fla.) has released a document outlining the challenges posed by China’s growth and proposing solutions to promote American prosperity and economic productivity.

Surprisingly, Rubio calls for higher capital gains taxes by increasing taxes on share repurchases (or stock buybacks). While the plan does not detail what kind of increase, it calls for equalizing the treatment of buybacks to dividends, which could subject them to a top rate of 37 percent.

This plan aims to curb share repurchases – which many wrongly claim comes at the expense of investment in the economy. In reality, buybacks occur because a company is reinvesting in itself and returning funds to shareholders, as Senator Toomey (R-Pa.) pointed out in a recent floor speech. Buybacks occur when there is no more productive investment left to make and are returned into the economy.

While Rubio’s plan is to increase investment, higher taxes on capital gains would have the opposite effect. Dividends are subject to two layers of taxation – at the business level and at the individual level either in the form of capital gains taxes (taxes on investment) or as ordinary income.

The better approach would be limiting the double taxation on dividends and capital gains in general. Specifically, dividends received should be taxed as capital gains or ideally not be taxed at all because they have already been taxed at the business level.

Senator Rubio deserves credit for proposing to make full business expensing permanent. This would promote continued investment in the economy.

However, this should not be done at the expense of higher capital gains taxes and restrictions on stock buybacks.