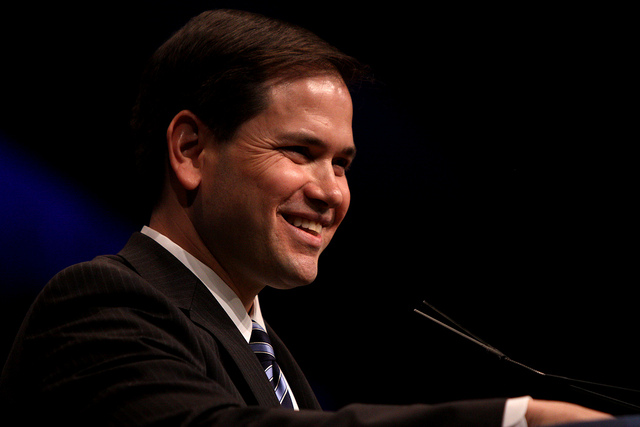

Senator Marco Rubio (R-Fl.) and Senator Mike Lee (R-Utah) released an op-ed in The Wall Street Journal this morning which proposed a comprehensive tax reform plan to “simplify the structure and lower rates.” ATR is supportive of three important components of their proposed tax plan.

First, ATR supports reducing the business tax rate. The current federal personal rate (paid by sole proprietors, partnerships, S-corporations, and LLCs) is 39.6 percent, while the federal corporate rate is at 35 percent. Rubio and Lee plan to reduce the corporate and non-corporate business tax rates, integrate all forms of business taxation, and eliminate double taxation: “On the business side, we would cut the current 35% corporate tax rate to make it competitive in the global economy… while integrating all forms of business taxation into a consolidated, single-layer tax.”

Second, ATR supports Rubio and Lee’s full expensing tax relief proposal. Under the current system, business investment purchases are subject to long, multi-year deductions called “depreciation.” Rubio and Lee propose: “We will also allow companies large and small to deduct their expenses and capital investments.”

Third, ATR supports Rubio and Lee’s territorial taxation proposal. Under current tax laws, foreign income is first taxed abroad and then taxed when brought home. This hurts U.S. businesses trying to compete internationally. Rubio and Lee propose: “We will also propose that businesses only be taxed in the country where income is actually earned, rather than double-taxed when the money is brought back home.”

These tax proposals are a great contribution to the current tax debate and anyone serious about tax reform should support these measures.