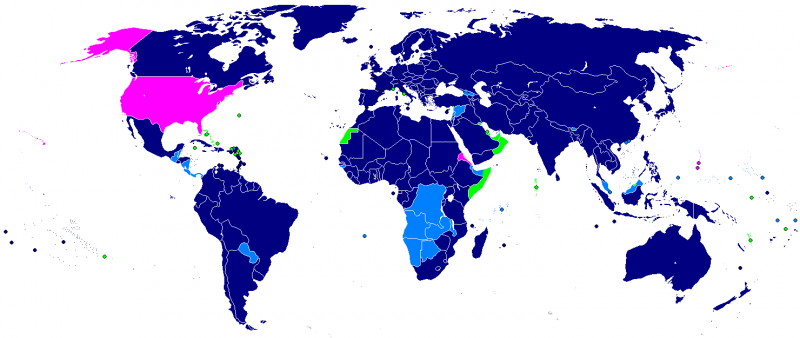

Today, the U.S. is one of two countries that has citizenship-based taxation. This outdated system affects an estimated eight million Americans that live abroad. The final tax reform legislation should implement territoriality for individuals through the establishment of residence-based taxation.

In support of residence-based taxation, ATR submitted a statement for the record to the House Ways and Means official hearing entitled, “Increasing U.S. Competitiveness and Preventing American Jobs from Moving Overseas.” Urging the committee to ensure that residence-based taxation is implemented in the final tax reform legislation. [Read The Full Letter Here]

Implementing territoriality for individuals is crucial because under the existing system, American businesses are disadvantaged when competing with foreign competitors for they face double taxation and burdensome international rules.

However, the system of worldwide taxation is not limited to businesses. American citizens also face this system as they are taxed regardless of whether they reside in the U.S. or in a foreign country.

Under this system, American citizens residing abroad must comply with complex IRS rules and are double taxed on income – once when they earn it overseas and again by the U.S. government solely because they are citizens.

Moving to territoriality for individuals will end this needless double taxation. This reform will also increase job opportunities for Americans overseas and reduce the power of the IRS.

Currently, American citizens working overseas face a disadvantage compared to expatriates from other countries when applying for employment, as it is substantially more expensive for a business to hire an American under these tax laws. Implementing residence-based taxation will reduces compliance burdens associated with hiring Americans so that U.S. citizens working overseas are hired on a more level playing field and thereby increase job opportunities for Americans.

Moving to residence-based taxation has the added effect of diminishing the need for the IRS to act as a global police force. Because citizens residing abroad would (in most cases) no longer need to worry about paying U.S. taxes, this reform could reduce the size and scope of the IRS international division, allowing the agency to be streamlined.

It is vital that any tax reform legislation includes territoriality for individuals. Implementing a system where Americans are taxed based on their residence would make tax compliance far simpler and should be part of the effort to simplify the code for individuals.