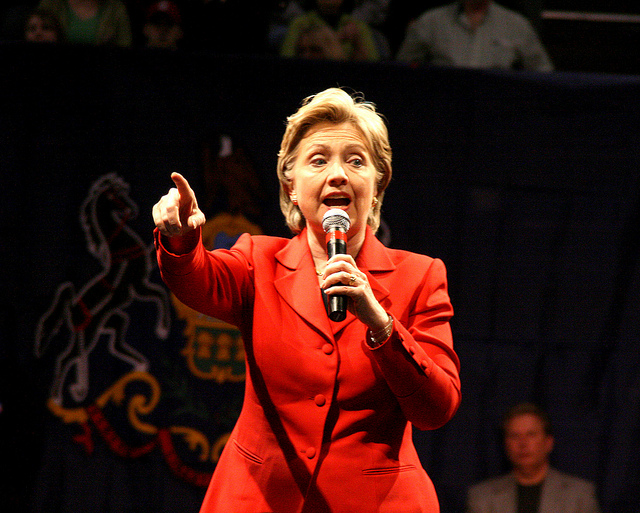

During a 2004 fundraiser, then-Senator Hillary Clinton spelled out her tax worldview to the assembled Democrat donors: “We’re going to take things away from you on behalf of the common good.” The comment was overheard and reported by the Associated Press.

Clinton made this comment as part of her proposal to repeal a set of tax cuts passed in 2001 and 2003 which lowered income tax rates and provided tax breaks for families, retirees, savers, and investors. While Clinton attempted to justify this position by claiming that only “the rich” would get hit, her tax hike would have saddled many small businesses with higher taxes.

According to 2012 IRS data (the most recent year available), 66 percent of small business profits would be subject to higher taxes if Clinton raised taxes on the highest income tax bracket.

In reality, The 2001/2003 tax relief package provided reduced income tax rates across the board, doubled the child tax credit from $500 to $1,000, raised the 15 percent bracket threshold to protect families from the marriage penalty, increased the contribution limit for retirement savings accounts from $2,000 to $5,000, and encouraged investment by cutting the capital gains tax rate from 20 percent to 15 percent and the top tax rate on dividend income from 38.6 percent to 15 percent.

But despite these tax cuts providing relief to American families Clinton has frequently argued they only benefited upper income earners. In the past she characterized this package of tax cuts as a “spendthrift tax plan” and a “plan targeted to a few.”