Featured Posts

ATR Supports Fight Against SEC’s Climate Rule

On March 21, 2022, the Securities and Exchange Commission (SEC) introduced a proposed rulemaking that required publicly traded companies to disclose information…

Commentary

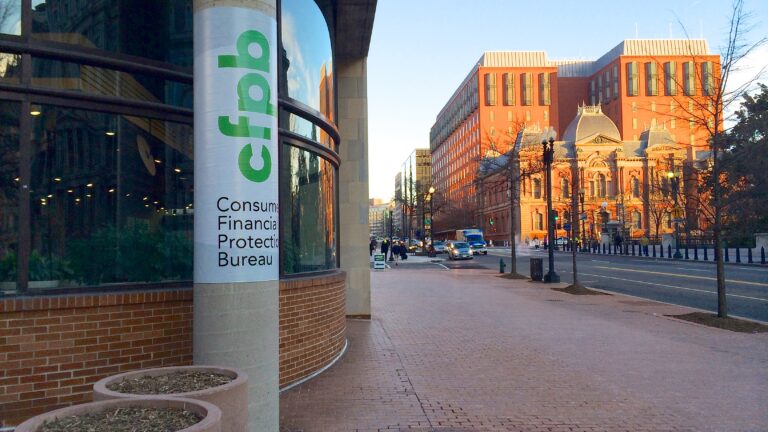

ATR Supports Fight Against CFPB’s Credit Card Late Fee Rule

Without any direction from Congress, the Consumer Financial Protection Bureau (CFPB) finalized a rule that (1) changes the safe harbor dollar amount for late fees…

Commentary

ATR Supports Fight Against FSOC’s Nonbank Designation Guidance

The Financial Stability Oversight Council (FSOC) was created by the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) as a response to…

Commentary

Filtered Posts

Congressional Proposals for Heightened Deposit Insurance Broaden Government Intervention and Cost Taxpayers

Commentary

ATR Organizes Coalition Letter Opposing Credit Card Competition Act of 2023

Letter

Fox Business Cites ATR’s BlackRock Tracker

Commentary

Federal and State Actions to Remove ESG Criteria from Retirement Money

Commentary

ATR Supports Rep. Warren Davidson’s Middle Class Borrower Protection Act

Commentary

ATR Supports Rep. Andy Barr’s Anti-ESG Bill

Commentary

ATR Opposes Reintroduction of Credit Card Competition Act

Commentary

Biden’s Financial Stability Oversight Council Launches Regulatory Assault on Financial Markets

Commentary

ATR Op-Ed in the Washington Examiner: “Biden administration’s banking reforms would empower government, not citizens”

Commentary

Tax Cuts, Paycheck Protection, Tort Reform Headline Florida Session Packed with Taxpayer Wins

Commentary