Tonight, in his State of the Union address, President Obama will propose a series of tax increases on the American people. One of these tax increases is indisputably an income tax hike on middle class families with children.

Under Obama’s plan, earnings in “Section 529” (named for its location in the Internal Revenue Code) college savings plans will face full income taxation upon withdrawal.

Under current law, earnings growth in 529 plans is tax-free if account distributions are used to pay for college tuition and fees. The Obama plan will tax earnings in these accounts even if they are used to pay for college tuition and fees.

These accounts are commonly used by middle class families. There are about 12 million 529 accounts open today, and they have an average account balance of approximately $21,000. Most 529 plans permit monthly contributions as low as $25 per month.

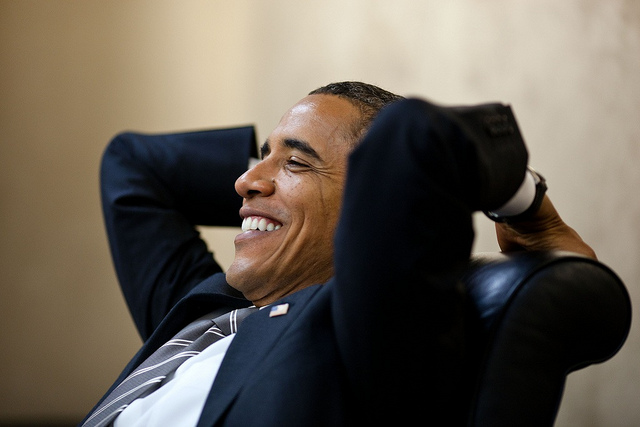

This middle class income tax increase is a clear violation of President Obama’s “firm pledge” against “any form of tax increase” on any family making less than $250,000. This promise to the American people is documented below:

Speaking in Dover, New Hampshire on Sept. 12, 2008, candidate Obama said:

“I can make a firm pledge. Under my plan, no family making less than $250,000 a year will see any form of tax increase. Not your income tax, not your payroll tax, not your capital gains taxes, not any of your taxes.” [Video]

During a nationally televised Vice-Presidential debate in St. Louis on Oct. 3, 2008, candidate Joe Biden said:

“No one making less than $250,000 under Barack Obama’s plan will see one single penny of their tax raised whether it’s their capital gains tax, their income tax, investment tax, any tax.” [Transcript]

In an address to a joint session of Congress on Feb. 24, 2009, President Obama restated the promise in forceful terms:

“If your family earns less than $250,000 a year, you will not see your taxes increased a single dime. I repeat: not one single dime.” [Transcript] [Video]

“Rather than raise taxes on middle class families trying to save for their children’s education, Obama should abolish the seven tax increases in Obamacare that directly hit middle-income Americans,” said Grover Norquist, president of Americans for Tax Reform.