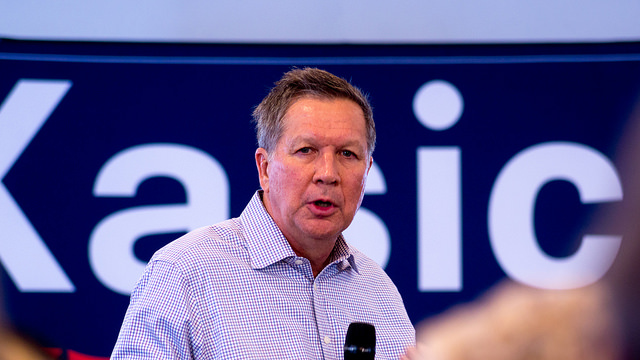

Americans for Tax Reform commends members of the Ohio Senate for declining to override Gov. John Kasich’s line-item-veto of a misguided effort to raise taxes on health insurance plans. The budget provision vetoed by Kasich would have had the state asking the federal government for permission to reinstate a tax on health insurers, and raise the rate from 5.85% to 7.2%, an effective 24% tax hike.

Some local government officials, hungry for more revenue that this tax hike would have funneled to them, are angry. But Ohio senators are right to stand up for taxpayers by allowing Kasich’s veto to stand. Ohio taxpayers have been hit with 20 federal Obamacare tax increases over the last eight years, along with the massive insurance premium hikes cause by President Obama’s signature achievement. Going hat in hand to Washington to request permission to pile on to this with another tax hike at the state level would add insult to taxpayer injury, and send the wrong message to employers and investors about Ohio.

Local governments should not be looking to blame Columbus for their bad spending plans. Instead, they should be making tough, but efficient spending decisions that favor taxpayers and the business climate of Ohio. Greg R. Lawson, research fellow at the Buckeye Institute, explains why the Senate’s decision to not override this veto was the right thing to do:

“This is not the time to raise taxes on health insurance plans, but it is time for local governments to justify their local spending to local taxpayers.”

In addition to ATR, the Ohio business community has been urging legislators to not override Kasich’s veto of this tax hike. The Ohio Chamber of Commerce and the National Federation of Independent Business, in a joint letter, stressed the negative effect this tax hike would have had on Ohio employers:

“If the additional tax were to be approved by CMS and subsequently implemented, the potential cost impacts are worrisome…Health insurance costs continue to rise year after year. They are consistently a top concern of most employers. In fact, in 2016 the average annual premium for an HMO plan with family coverage significantly increased. Employers can’t just absorb higher premium costs due to government interference in the marketplace.”

“It was unfortunate that the Ohio House of Representatives advanced this effort to raise taxes on hard-working Ohioans,” said Americans for Tax Reform President Grover Norquist. “Thankfully the Senate stepped up to stop it from moving forward. I applaud Senate President Larry Obhof, Senate President Pro Tempore Bob Peterson and their colleagues standing up for and protecting Ohio taxpayers.”