The North Carolina Senate approved their budget last week and it includes significant tax relief for businesses, individuals, and families across the Tarheel state.

The Senate budget proposal is very similar to the one already passed in the House. Both reduce the corporate franchise tax by nearly a third and provide income tax relief by increasing the standard deduction. The reduced franchise tax is designed to favor North Carolina-based companies and discourage them from moving elsewhere.

Overall, the proposed tax cuts are predicted to save taxpayers and businesses in North Carolina about $250 million a year and encourages more businesses to move and stay in the state. These pro-growth cuts were aided by revenue collections that are beating projections by close to $640 million, the largest surplus North Carolina has experienced since the Great Recession.

“This budget continues those policies [tax cutting policies],” Berger, a Rockingham County Republican, said at a news conference. “Those are policies that have brought about North Carolina’s success story.”

“Over the past decade North Carolina lawmakers have been able to generate repeated budget surpluses while providing billions of dollars in tax relief. How? By doing what their counterparts in Kansas and other states have failed to do, which is keep spending in check,” said Grover Norquist, president of Americans for Tax Reform. “I commend both the North Carolina House and Senate for approving new budgets that keeps growth in state spending in line with population growth and inflation.”

While the North Carolina Senate and House have passed budgets that include tax relief for the entire state, the proposals still faces an obstacle in the form of Democratic Governor Roy Cooper, who has promised to veto more tax relief. Because the Republicans cannot override a veto alone, the budget process still has a long fight before being able to provide real relief.

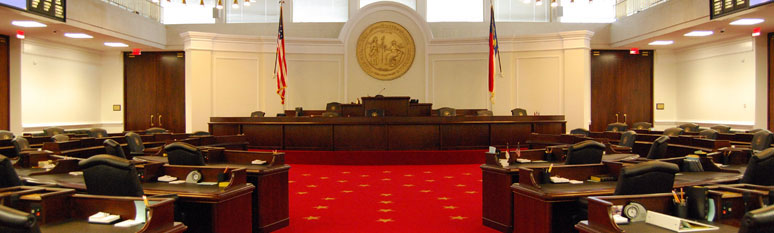

Photo Credit: North Carolina General Assembly