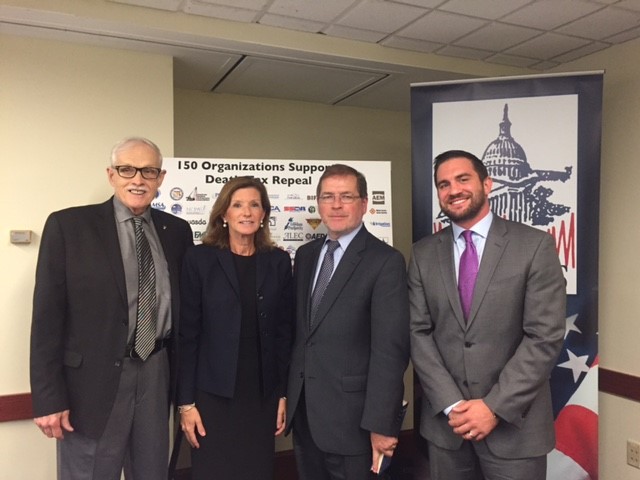

Today, ATR president Grover Norquist appeared as a panelist for the 60 Plus Association’s event on Death Tax repeal. Norquist spoke about the importance of permanent Death Tax repeal in the GOP tax reform framework, arguing that the tax hinders the economy as well as future economic growth and job creation.

He noted that repealing the Death Tax is another crucial factor in boosting international competition along with reducing business and corporate tax rate.

Using statistics gathered by the Tax Foundation, Norquist stated, “Abolishing the Death Tax would increase the economy by eight tenths of a point, almost a point 1 percent increase, and 159,000 full time jobs would be added.”

Panelists also included Death Tax experts such as: Jim Martin, Chairman and President of the 60 Plus Association, Karen Kerrigan, President and CEO of the Small Business & Entrepreneurship Council and Palmer Schoening, Founder and Chairman of the Family Business Coalition.

The Death Tax originated in 1797 to increase funding for naval expansion before being repealed shortly after in 1802. The tax would not be seen again until 1862 to pay for Civil War efforts. It would once again be repealed, but the tax would continue to follow this pattern, being implemented in 1898 and 1916 to help pay for the Spanish-American War and World War I respectively.

While the tax was repealed less than five years after its implementation during the Spanish-American War, it has never been repealed again. The tax has remained in our tax code for over a century, since 1916.

It is time to abolish the Death Tax. Permanently. The GOP tax reform plan achieves this.