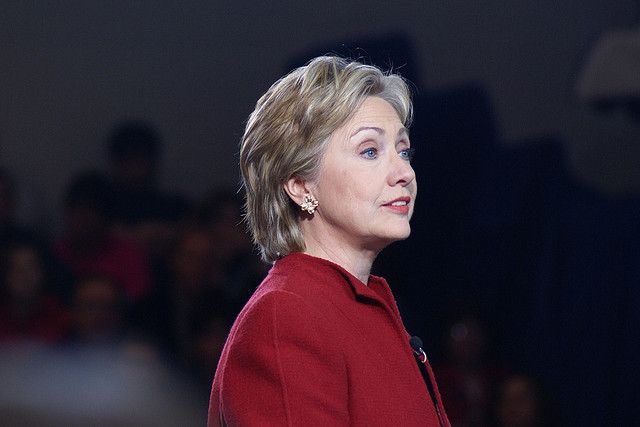

Today Hillary Clinton called for a “Buffett Rule” tax increase on the American people. Though taking various forms, a “Buffett Rule” generally requires that taxpayers with bigger incomes face a higher tax rate than others. According to several methods of calculation, they already do.

But Hillary Clinton doesn’t have to wait for a Buffett Rule of her design to pass Congress. She can make a voluntary payment to the United States Treasury right now.

“Anyone who would like to voluntarily pay more in taxes can do so,” said Grover Norquist, president of Americans for Tax Reform. “Hillary’s demand that others pay additional taxes when she has refused to do so for years is the height of hypocrisy.”

Any American may make a donation today simply by writing a check to the Treasury, to a fund called Gifts to the United States:

How do I make a contribution to the U.S. government?

Citizens who wish to make a general donation to the U.S. government may send contributions to a specific account called “Gifts to the United States.” This account was established in 1843 to accept gifts, such as bequests, from individuals wishing to express their patriotism to the United States. Money deposited into this account is for general use by the federal government and can be available for budget needs. These contributions are considered an unconditional gift to the government. Financial gifts can be made by check or money order payable to the United States Treasury and mailed to the address below.

Gifts to the United States

U.S. Department of the Treasury

Credit Accounting Branch

3700 East-West Highway, Room 622D

Hyattsville, MD 20782

Taxpayers look forward to the news of your contribution, Mrs. Clinton.